sBOLD: Turning a Decentralized CDP Stablecoin into a Yield-Bearing Asset

In our previous blog post, we outlined the architecture of Liquity V2’s Collateralized Debt Position stablecoin, BOLD, highlighting its distinct advantages over legacy protocols in the market. Drawing inspiration from its robust, autonomous economic incentives and value distribution model, we’ve decided to develop a range of products on top of it.

The first one, the sBold Protocol, tokenizes Liquity’s Stability Pools, turning BOLD into a delta-neutral, yield-bearing asset dubbed sBOLD. The protocol aims to enable broader DeFi integrations, enhancing the capital efficiency and expected returns of the BOLD holders; accommodating certain integrations; and ultimately supporting Liquity V2’s ecosystem growth.

In this article, we will dive into the design decisions behind the sBold Protocol, explore its technical architecture and offer a glimpse into the exciting use cases it unlocks. Finally, we will outline the long-term vision of the project.

Protocol Rationale

By enabling productive collaterals such as rETH and wstETH, Liquity made a giant leap towards lowering the effective borrowing cost for its users. Moreover, the user-set interest rate model caters to both active DeFi participants and “set-and-forget” borrowers. However, BOLD is a debt position by definition: you either pay interest for holding it or deposit it into the backstop liquidity module (Stability Pool) to get a cut out of the interest paid by the borrowers, while simultaneously sacrificing your liquidity.

The question is: can you have your cake and eat it too? Surprisingly, the answer is yes. We asked ourselves: What if instead of using BOLD as collateral, we tokenize the Stability Pool deposits and use the derivative instead? That way, users are both getting a proportionate cut from the interest accrued in the Stability Pool, while simultaneously retaining access to the funds for DeFi allocations. Suddenly, BOLD turns into a liquid, yield-bearing asset.

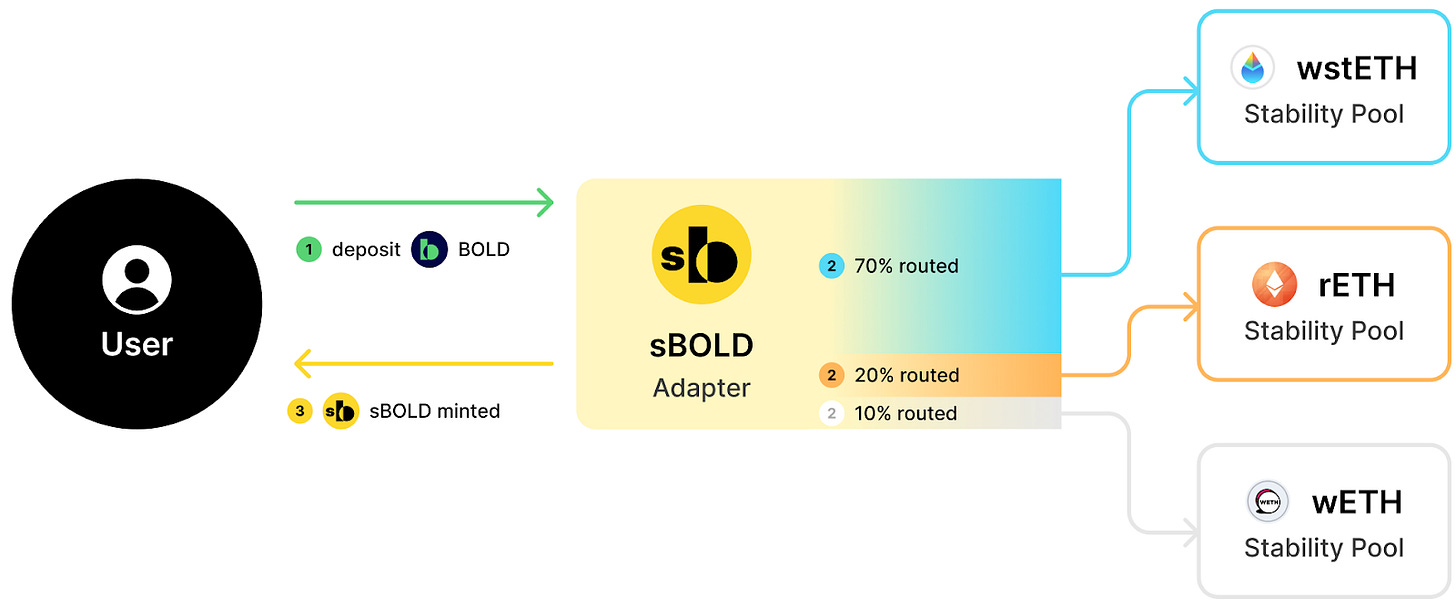

Enter sBold Protocol. It allows BOLD holders to deposit the stablecoin into a vault that simultaneously distributes the inventory across all three Stability Pools based on predefined weights. In exchange, depositors receive sBOLD, an ERC4626 token, that accrues a pro-rata share of the interest paid to the Stability Pools. Simultaneously, it could also be used in various protocols across the DeFi ecosystem.

sBOLD holders capture the liquidation penalty with minimum collateral price exposure. Theoretically, Stability Pool depositors acquire liquidated collateral at a 5% discount. However, the gain is not realized until the collateral is sold for the underlying asset, BOLD. sBold Protocol automates the process on behalf of its users by incentivizing solvers to swap the liquidated ETH and LSTs into BOLD as quickly as possible. The architecture does not only remove the ETH price exposure, but also creates a delta-neutral stablecoin that could be integrated with money markets and yield trading platforms with no concerns of bad debt or de-pegs. Furthermore, market volatility is mitigated through the way Liquity handles liquidations which differs from the remaining CDPs and lending platforms on the market.

Both Aave and Sky (formerly MakerDAO) rely on just-on-time external liquidity to process collateral liquidations. The process typically involves partial sale either to the highest bidders or at a predefined discount to the market price. Liquity, on the other hand, relies on idle capital in the Stability Pool which is stickier and less affected by market volatility. While Liquity’s approach creates a more robust system, it also ties large amounts of capital that would otherwise not be utilized in the most productive manner.

The sBold Protocol adds a twist to the original Liquity design, by taking the best of both worlds. It participates in Liquity’s liquidation engine, but also relies on just-on-time collateral redemptions and divestments. As a result, sBOLD has little price exposure to the collaterals supported and could act as de-facto yield-bearing stablecoin on its own. At the extreme, if 100% of the BOLD is deposited into the Stability Pools via sBOLD, Liquity’s liquidation engine behaves similarly to Aave and MakerDAO.

Architecture

The sBold Protocol is built around the prevalent and industry-compatible ERC4626 standard, which serves as an entry point between external accounts and the core underlying mechanism. The protocol accepts BOLD deposits and routes them into the wstETH, rETH, and wETH stability pools in fixed proportions (70%, 20%, and 10%, respectively). In return, the depositor receives sBOLD tokens that could be integrated with third-party protocols.

sBOLD possesses a rebalancing feature by which the weights of each respective Stability Pool can be changed due to market conditions, so the incoming BOLD deposits are provided with the new ratios to the respective set.

The exchange rate of sBOLD is calculated as the sum of all BOLD held by the contract in each Stability Pool (including accumulated interest) divided by the total supply of sBOLD vault shares. As a result, it acts as a compounding token similar to sUSDe or weETH.

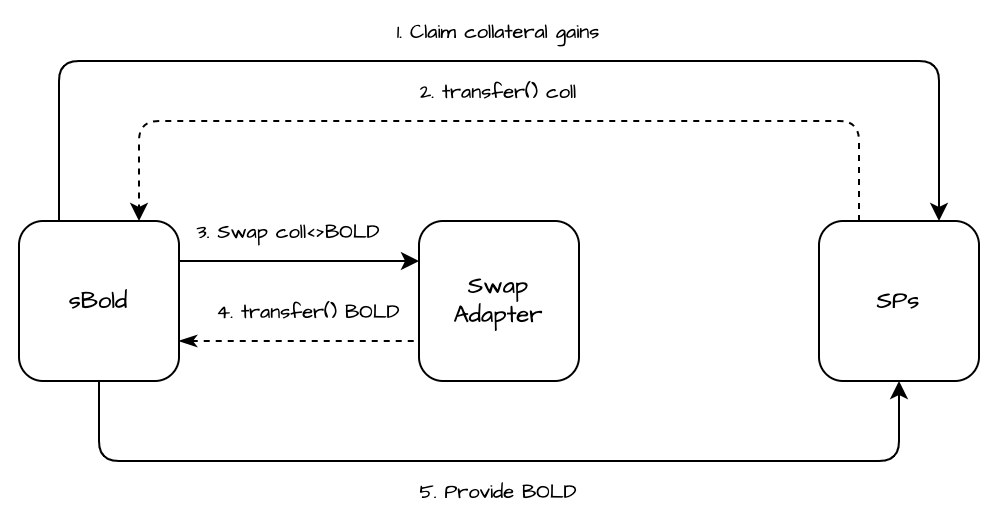

sBOLD introduces a mechanism for collateral aggregation across each internally operational Stability Pool on Liquity v2, which claims the accumulated liquidated collateral and swaps it into BOLD with a low boundary, based on slippage tolerance configuration. After the swaps are successfully executed, the contract deposits the acquired amount of BOLD with the same preset weights to each Stability Pool.

A swap could be triggered by any account that provides call data, which will result in an amount of primary assets more or equal to the minimum BOLD required. The swaps can be partial and for a single collateral to ensure system's flexibility, meaning that an account could exchange only a fraction of the collateral amount for one or more pools in case of insufficient market liquidity.

The sBold Protocol will onboard only trusted adapters, which is an industry standard, or internally owned and resilient strategists. Initially, the Protocol will rely on the battle-tested 1inch v6 router to aggregate the best liquidity options.

Integrations

sBOLD is built with DeFi composability and integrations in mind. As a yield-bearing, compounding token, the product is a collateral of choice. Money markets integrations could facilitate:

Interest rate arbitrages when the borrowing rates of the fiat-backed stablecoins are below the sBOLD yield;

Cost-efficient off-ramping through USDC and USDT;

Capital-efficient peg stabilization, allowing users to borrow and sell BOLD using sBOLD when the underlying is trading at a premium.

Due to the inherent variability of sBOLD’s yield, the asset serves as an interesting playground for yield traders on platforms like Pendle and Spectra. Combining the innovative design of Liquity with sBOLD creates a set of strategies where a user could fix both their borrowing rate on Liquity and their expected yield on BOLD holdings, creating a low-risk arbitrage opportunity.

Last but not least, sBOLD might be the preferred collateral for re-staking protocols due to its price stability, decentralization, and immutability, on the other.

Audits

At K3 Capital, we are primarily a DeFi liquidity provider and a developer. As a result, we understand how paramount the security of the codebase is to users. We took the lessons learned over the years and applied them to the sBold Protocol. We traded complex codes and overly flexible parameters for simple and safe logic.

The contracts are kept as immutable as possible, leaving a few upgradable functions, allowing us to change parameters in case of a dramatic market shift.

The sBold Protocol underwent rigorous code reviews by ChainSecurity. The company has also audited Liquity V2 and is familiar with the nuances of the underlying code design and tail risks.

The Road Ahead

First, Liquity’s forkenomics model allows sBOLD to go crosschain seamlessly. We are already in touch with some of Liquity’s friendly forks and looking forward to speaking with everyone interested to collaborate.

However, we aim to not simply tokenize the Stability Pools. The novel design of Liquity V2 leaves the door open to rate arbitrage between the interest a user pays on their Trove and the yield sBOLD generates.

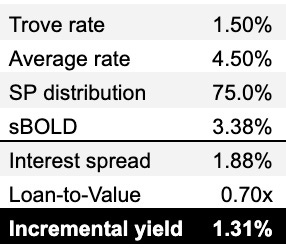

To put it into perspective, assume Alice sets a 1.50% rate for her credit line, the weighted average interest rate on the platform is 4.5% and the revenue distribution to the Stability Pools remains 75%. In this scenario, the yield of sBOLD is 3.38%, meaning that Alice could earn 1.88% from her credit line. If we assume a loan-to-value ratio of 0.70x, the incremental return on her collateral would be 1.31%:

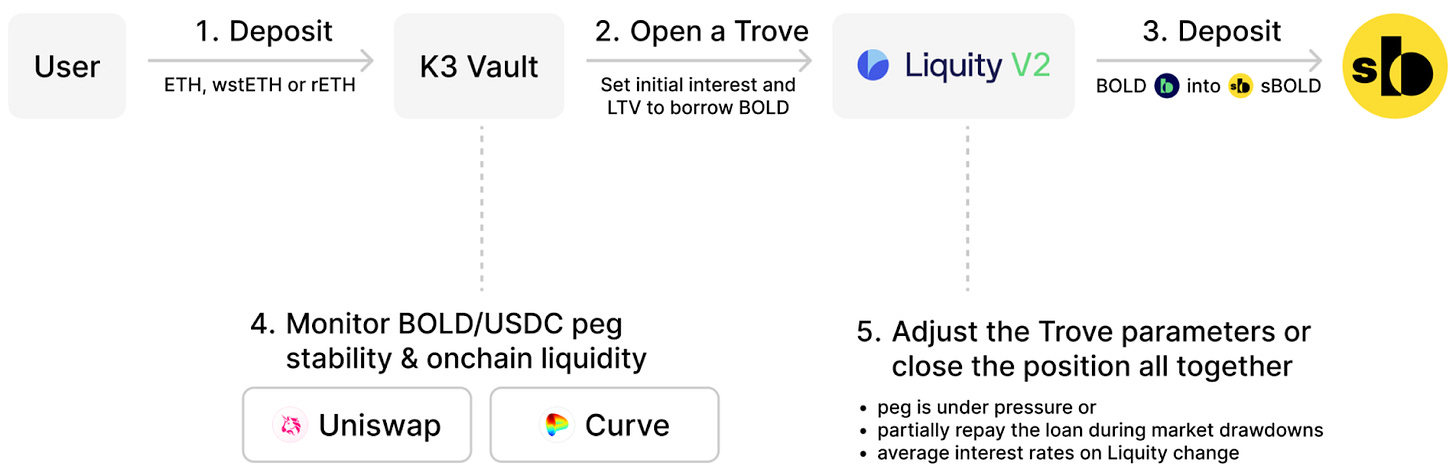

But how is Alice assured that her interest rate is always below the sBOLD yield and simultaneously not carrying the potential redemption risk? Enters the K3 Vault:

Alice deposits her ETH or LSTs into the K3 Vault. It automatically opens a Trove with the initial interest rate set below the sBOLD yield and LTV based on the market conditions. The borrowed BOLD is simultaneously deposited into sBOLD to earn a yield that more than offsets the interest paid on the credit line.

K3 actively monitors the mempool for peg weaknesses. If there are signs of downward price pressure, the K3 vault automatically assesses the size of the potential redemptions and the behavior of the other borrowers to either increase the interest rate of the Trove or repay the debt in case the strategy is no longer profitable.

Finally, if unexpected redemptions happen, the Vault withdraws the BOLD accumulated and trades them back into the initial collateral asset.

To learn more about sBOLD, please visit Protocol’s documentation or join our dedicated Telegram channel.