Onboarding Wall Street Veterans On-Chain

Tokenized Stocks & Ondo Global Markets

Today, the global stock market capitalization stands at approximately $125 trillion. In stark contrast, the total cryptocurrency market capitalization is around $4 trillion according to Coingecko. This implies a nearly 30x difference when comparing the market capitalizations of the two markets.

Historically, the emergence of financial instruments such as stocks and bonds quickly gained traction during the early 1700s, which initially were accessible primarily to select groups of investors and merchants. During this period, transactions were generally cash-based, documented merely on paper where this informal arrangement often led to instability and mistrust among market participants.

The Debut of ‘Securities’ Trading Framework

In 1792, speculation with government bonds and widespread defaults, notably by financier William Duer, exposed severe weaknesses in the financial system. The ensuing market instability prompted Alexander Hamilton, the first U.S. Secretary of the Treasury, to intervene and stabilize the markets by leveraging the First Bank of the United States to restore liquidity.

In response to this financial crisis, on May 17, 1792, a significant meeting took place under a buttonwood tree on Wall Street in New York City. At this gathering, 24 leading brokers and merchants signed the Buttonwood Agreement, which set forth two critical provisions: members would exclusively trade among themselves, and a standardized commission rate of 0.25% per trade was established. This landmark agreement aimed to introduce greater transparency, trust, and stability into the securities market.

Following this informal yet pivotal accord, trading moved indoors to the Tontine Coffee House at Wall and Water Streets as membership expanded. By 1817, this group formally organized itself as the New York Stock and Exchange Board, later becoming known as the New York Stock Exchange (NYSE) in 1863. Until today, the NYSE remains one of the most influential and respected financial marketplaces in the world.

Structural Limitations of Today’s Stock Exchanges

The infrastructure supporting the securities markets has undergone substantial modernization over the past few centuries. Innovations such as algorithmic execution, digital trading, and stringent regulatory frameworks have enhanced market integrity, operational efficiency, and investor protection. However, despite these advancements, structural limitations remain.

Traditional securities markets operate with fixed schedules, restricting trading to set windows (e.g., 9:30 AM to 4:00 PM ET for NYSE and NASDAQ), which impedes investors' ability to react promptly to after-hours geopolitical or macroeconomic developments. For example, during the collapse of Silicon Valley Bank in March 2023, market participants had to wait until the next trading day to execute positions, despite the situation unfolding rapidly over a weekend.

Moreover, high entry barriers such as the need to purchase full shares and meet minimum capital thresholds often exclude retail or international investors from participating fully. Settlement processes still adhere to the T+2 timeline, delaying final ownership transfer and introducing counterparty risk. Finally, access remains fragmented due to jurisdictional regulations and brokerage restrictions, making cross-border equity investment more complex and costly.

In this article, we explore the synergies between blockchain and the traditional stock market, underlying mechanics of tokenized stocks, and diving into Ondo Finance’s unique approach to bridging the two worlds.

The Convergence of Stock Trading Market and Blockchain

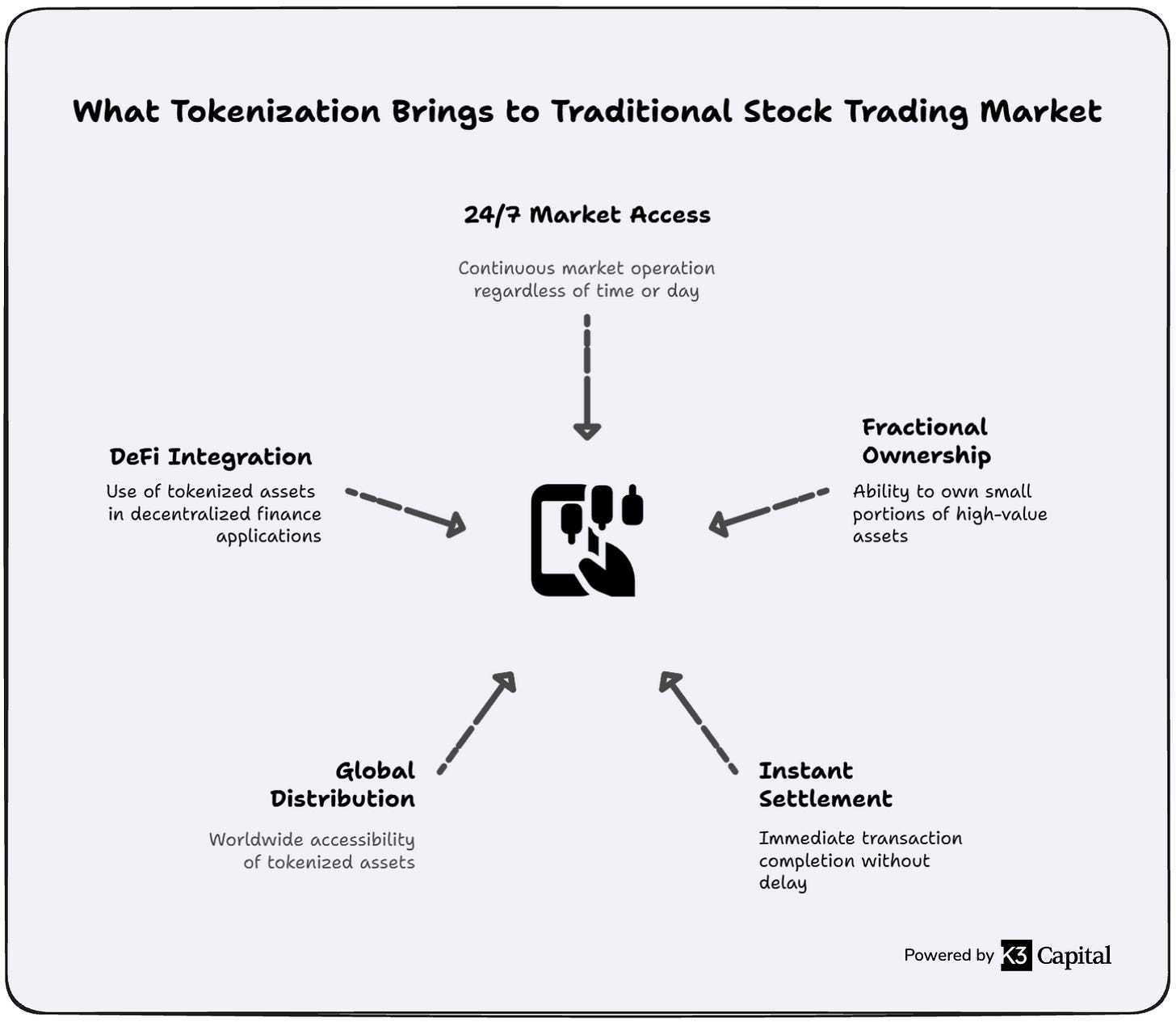

Despite knowing that not every asset must migrate on-chain, tokenization directly addresses the structural frictions that continue to hamper conventional stock markets. It brings several transformative benefits that not only improve capital efficiency and accessibility but also expand the functional utility of traditional financial assets in a programmable and globally accessible format.

24/7/365 Market Access

Blockchain rails keep markets open around the clock. Investors no longer wait for Wall Street’s opening bell to react to earnings releases, geopolitical shocks, or liquidity crises.

Fractional Ownership

Smart‑contract standards allow each share to be split into arbitrarily small units. Instead of paying more than US $500 000 for a single Berkshire Hathaway Class A share, an investor can acquire precisely $100 worth of it. Fractionalisation lowers entry barriers, supports automated micro‑investment plans, and enables broader portfolio diversification.

Instant (T+0) Settlement

Traditional stock trading is clear on a T+2 basis, exposing counterparties to settlement and funding risk. On‑chain transfers settle within seconds, eliminating overnight credit exposure, reducing operational cost, and freeing capital for immediate reuse.

Global Distribution

Tokenized stock issued as ERC‑20 or SPL assets can circulate wherever an internet connection and a compliant wallet exist. Integrated KYC at mint/redeem and sanctions screening for secondary transfers preserve regulatory integrity while allowing permissionless liquidity across jurisdictions.

Composability & DeFi Integration

Once stocks are brought on-chain, they become composable assets within the broader DeFi ecosystem. These tokenized stocks can be used as collateral, deployed into liquidity pools, integrated into structured yield strategies, or borrowed against to unlocking capital efficiency and enabling more dynamic financial use cases.

While stock markets are mature and liquid for major stocks, they remain operationally constrained by business-hour trading windows, batch settlement cycles, and limited access for many global investors. Similar to traditional bond markets, the inefficiencies in the equity markets create a compelling opportunity for blockchain-based solutions that offer 24/7 trading, near-instant settlement, and direct ownership transfer with fewer intermediaries and extend the reach of traditional exchanges like NYSE or Nasdaq rather than replacing them.

Mechanics behind Tokenized Stocks

Broadly, there have been two models. One is fully-backed tokens: for every token on-chain, a real share is held by a custodian. This is akin to stablecoins for stocks - the token is a digital twin of a share held in reserve. The second model is synthetic or oracle-driven tokens, which track stock prices via smart contracts without any real shares backing them. A third emerging approach is derivative tokens (perpetual futures), providing stock exposure via on-chain contracts without actual share settlement. Each model has trade-offs in compliance and risk. Fully-backed tokens offer the legitimacy of real underlying assets, while synthetics offer permissionless access, but can diverge from real values if not arbitraged appropriately.

Historical challenges

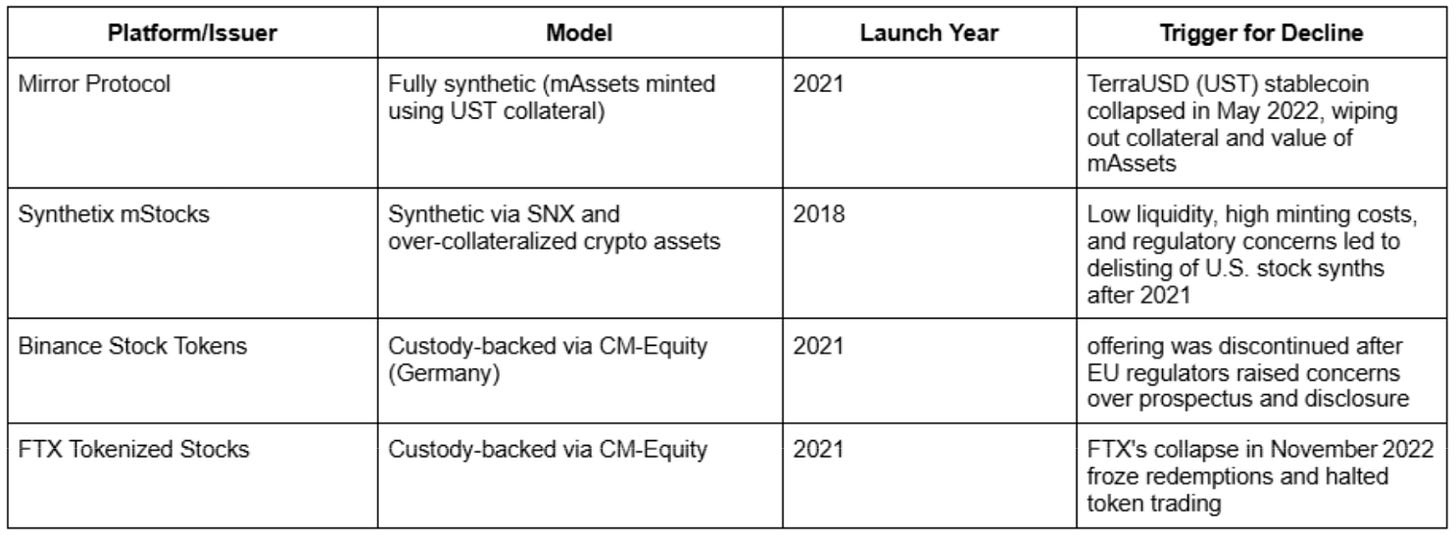

The first wave of on‑chain stocks emerged on synthetic‑asset platforms like Mirror Protocol (on Terra) and Synthetix. They minted on‑chain twins of U.S. equities backed by volatile collateral and oracles. Meanwhile, centralized exchanges including Binance and FTX rolled out custodial stock tokens without robust jurisdictional clarity.

Early tokenized stock initiatives failed largely due to a combination of regulatory ambiguity and structural weaknesses. Projects like Mirror Protocol and Synthetix relied on synthetic asset models backed by volatile collateral such as UST or SNX, making them highly susceptible to market shocks and depegging events. Centralized exchanges like Binance and FTX attempted custodial models but lacked transparent regulatory frameworks and sufficient disclosures, drawing scrutiny from financial regulators. The absence of investor protections, compliance with securities laws, and reliable redemption mechanisms ultimately eroded user trust and led to widespread shutdowns. These shortcomings revealed the importance of fully collateralized, legally compliant frameworks, paving the way for a new generation of tokenized equity providers.

1:1 Backed Models

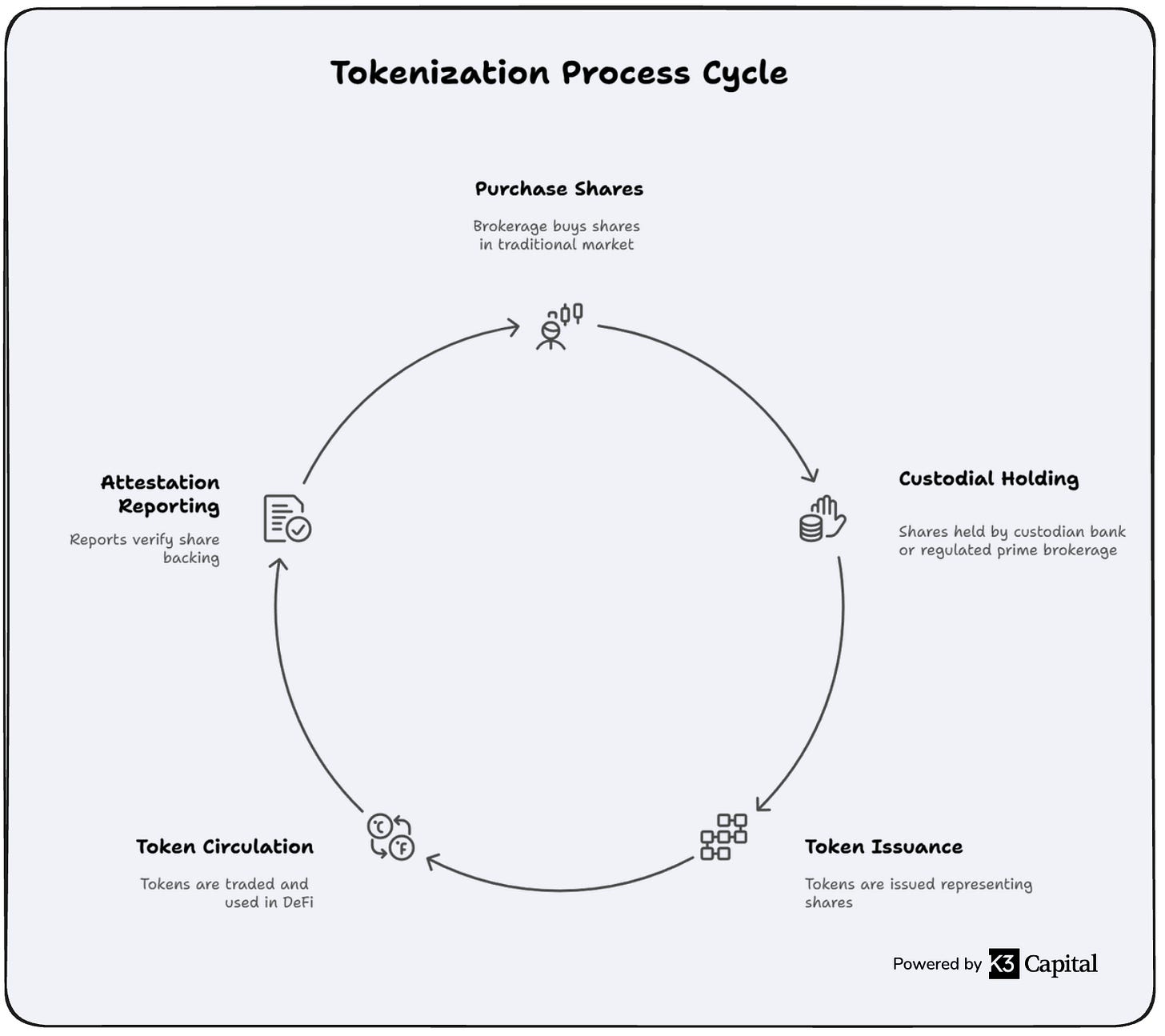

The process of turning a stock into a token involves a custodial infrastructure and blockchain issuance. In a simplified schematic, an authorized brokerage or special purpose vehicle (SPV) buys actual shares of a stock in the traditional market and holds them with a qualified custodian bank or regulated prime brokerage. For each real share held, an equivalent number of crypto tokens is issued on-chain. This ensures each token is 100% backed by an actual share in reserve.

The tokens are usually issued under regulatory approval. These tokens can then circulate in the crypto ecosystem: traded on exchanges, held in wallets, or used in DeFi protocols, while the underlying shares remain with the custodian. Periodically, the issuer or custodian publishes attestations or reports to verify that the shares backing the tokens are still held in custody (similar to how a stablecoin issuer reports its reserves).

How is the stock price maintained on/off-chain?

An important aspect of tokenized stocks is how their on-chain price stays aligned with the real stock price. Unlike purely crypto assets, these tokens have an objective reference price (the stock’s market price) and a redemption mechanism. In practice, the issuer or its liquidity providers act much like an ETF’s authorized participants or arbitrageurs. If the token price drifts too high above the actual stock, they can sell the token (or create new tokens by depositing more shares) to bring the price down; if the token trades too low, they can buy and redeem tokens for the underlying shares.

Market Players

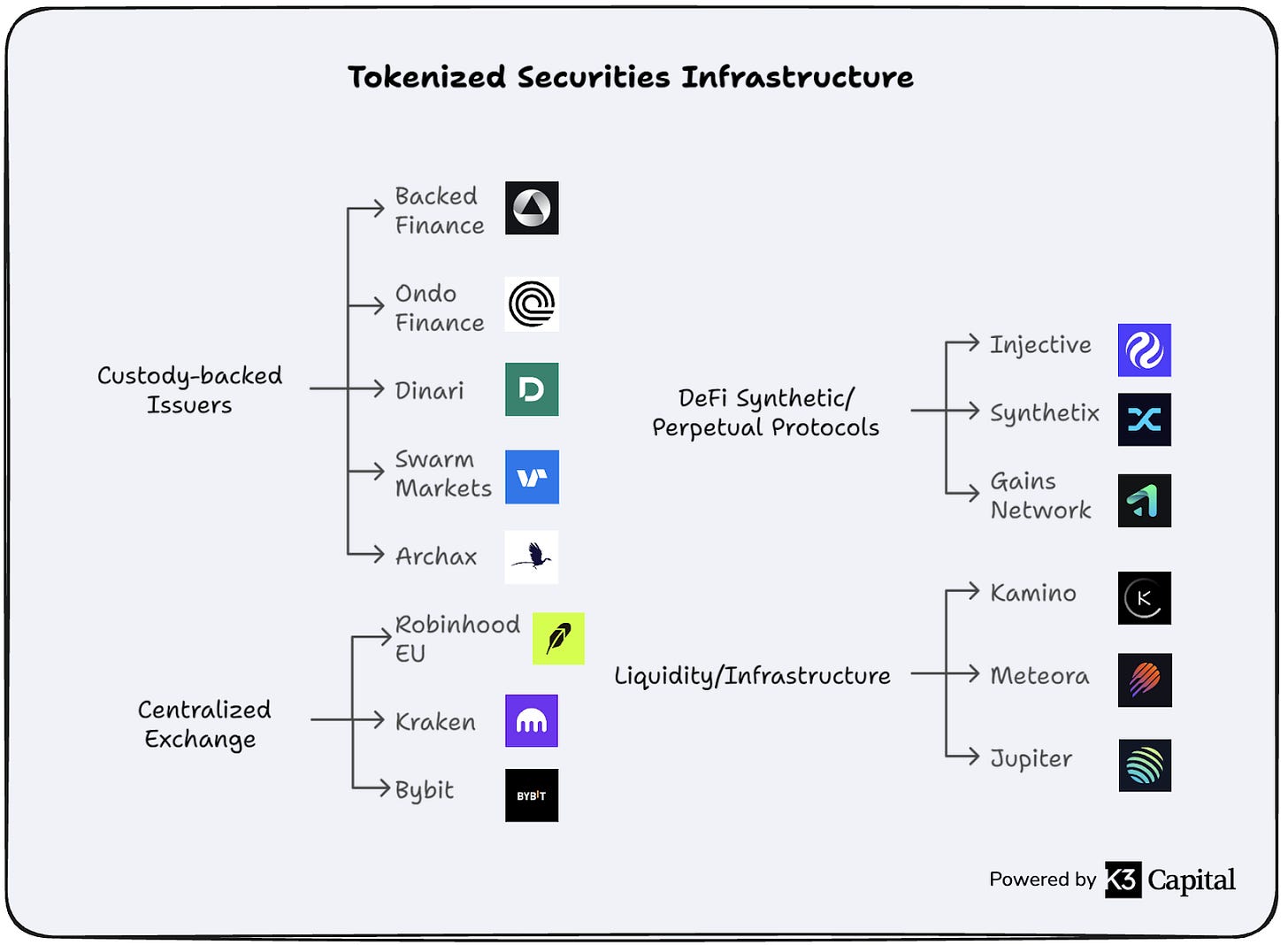

The tokenized stock sector has matured since the 2021–22 shake‑out. A new cohort of compliance‑first issuers now delivers fully collateralized, redeemable stock tokens, while DeFi protocols cater to traders seeking synthetic exposure and leverage. At the same time, traditional exchanges and decentralized liquidity engines have become key distribution channels.

The current tokenized securities market includes the following key players and fails into four functional layers:

Custody‑backed Issuers: platforms such as Backed Finance, Ondo Finance, Dinari, Swarm Markets, and Archax mint equities-backed tokens that are each representing 1:1 the underlying shares held with regulated broker‑dealers. Their focus is compliance, daily reserve attestations, and on‑demand redemption, providing investors with the closest on‑chain analogue to traditional equity ownership.

Centralized Exchanges: venues like Robinhood EU, Kraken, and Bybit distribute those custody‑backed tokens to a mainstream audience by listing spot trading pairs and offering fiat or stable‑coin ramps.

DeFi Synthetic / Perpetual Protocols: projects like Injective, Synthetix, and Gains Network deliver oracle‑priced perpetuals or synthetic shares. They appeal to traders who require leveraged exposure without touching the fully‑backed receipts.

Liquidity Infrastructure: money markets like Kamino allow tokenized stocks to be used as collateral to borrow crypto assets, while Meteora and Jupiter aggregate routes and automate concentrated‑liquidity positions for SPL stock tokens.

These layers illustrate how tokenized equity markets are maturing into a full-stack compliant issuance, centralized distribution, permissionless derivatives, and on‑chain liquidity plumbing; bringing traditional capital structures on-chain while adding 24/7 accessibility.

Ondo Finance Approach

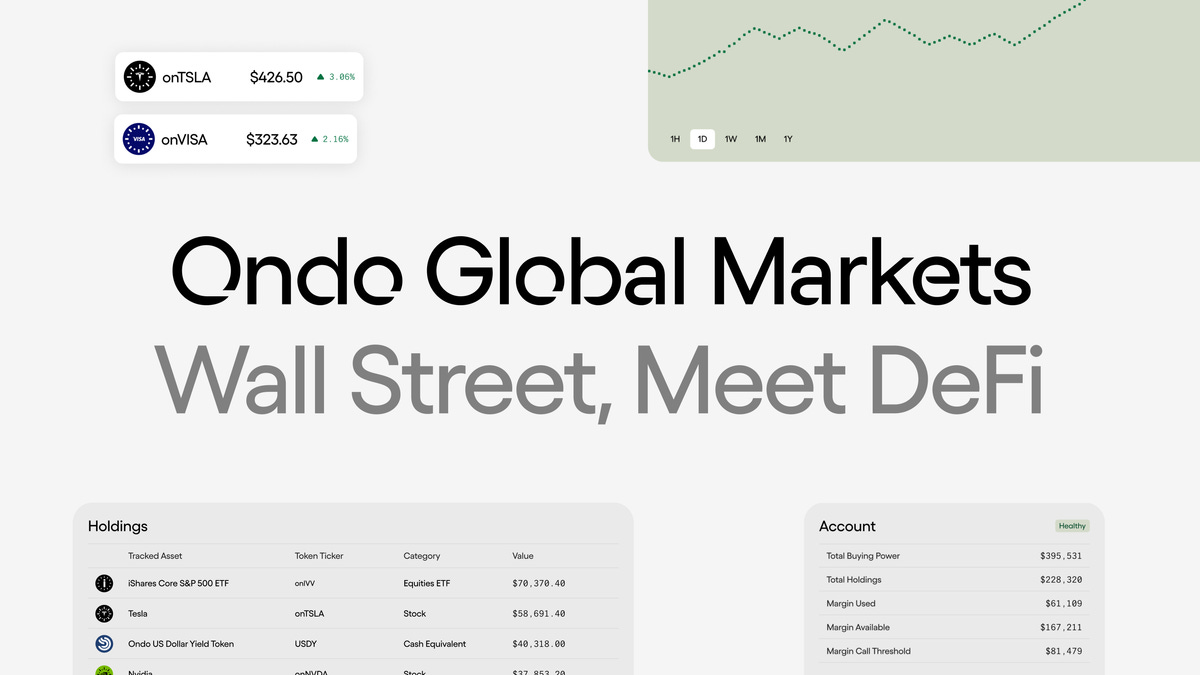

While there are many issuers with different approaches, Ondo has its own unique model. On 4 February 2025, Ondo Finance announced Ondo Global Markets (GM) in its article “Ondo Global Markets: Wall Street, Meet DeFi”

Ondo Global Markets is a compliance-first platform designed to bring U.S. securities such as stocks, bonds, and ETFs on-chain for non-U.S. investors. By issuing fully collateralized, redeemable tokens backed 1:1 by real-world assets, Ondo GM unlocks institutional-grade access to traditional markets while enabling global, 24/7/365 on-chain transferability with 24/5 mint and redeem.

Through its APIs and SDKs, Ondo empowers developers and protocols to integrate regulated tokenized assets into their products, creating a foundation for a new generation of decentralized financial services. But beyond its technical infrastructure, the platform is built to serve a wide array of stakeholders, from retail users to institutions and crypto-native platforms.

Ondo Global Markets is designed to serve a wide range of stakeholders across both traditional and crypto-native ecosystems. For individual investors outside the U.S., it offers low-friction access to U.S. securities through stablecoins, along with the ability to participate in on-chain financial services like lending and derivatives. Traditional broker-dealers can use the platform to reduce the operational complexity of offering U.S. equities to international clients while unlocking new services through integration with third-party protocols. Asset managers and issuers, including robo-advisors, benefit from a global distribution channel and the ability to transparently manage tokenized portfolios using compliant on-chain infrastructure. Finally, crypto-native platforms such as wallets, exchanges, and DeFi protocols gain the ability to offer users exposure to regulated securities and enable new cross-collateralized use cases that blend traditional assets with digital finance.

Ondo GM enables 24/7/365 secondary trading of tokenized securities by integrating directly with traditional financial infrastructure, rather than relying on on-chain AMMs or liquidity pools. Trading occurs exclusively among whitelisted market makers through a Request-for-Quote (RFQ) model, ensuring institutional-grade execution. While this structure unlocks continuous access and real-time trading, it also presents a key challenge: maintaining accurate pricing during off-market hours when traditional exchanges are closed.

Ondo addresses the challenge of off-market trading hours by enabling arbitrageurs to help keep secondary market prices aligned with real-world assets, even during weekends. Rather than attempting to recreate liquidity on-chain, Ondo GM inherits it directly, fetching the liquidity from traditional financial markets ensures that token pricing remains anchored to the underlying securities.

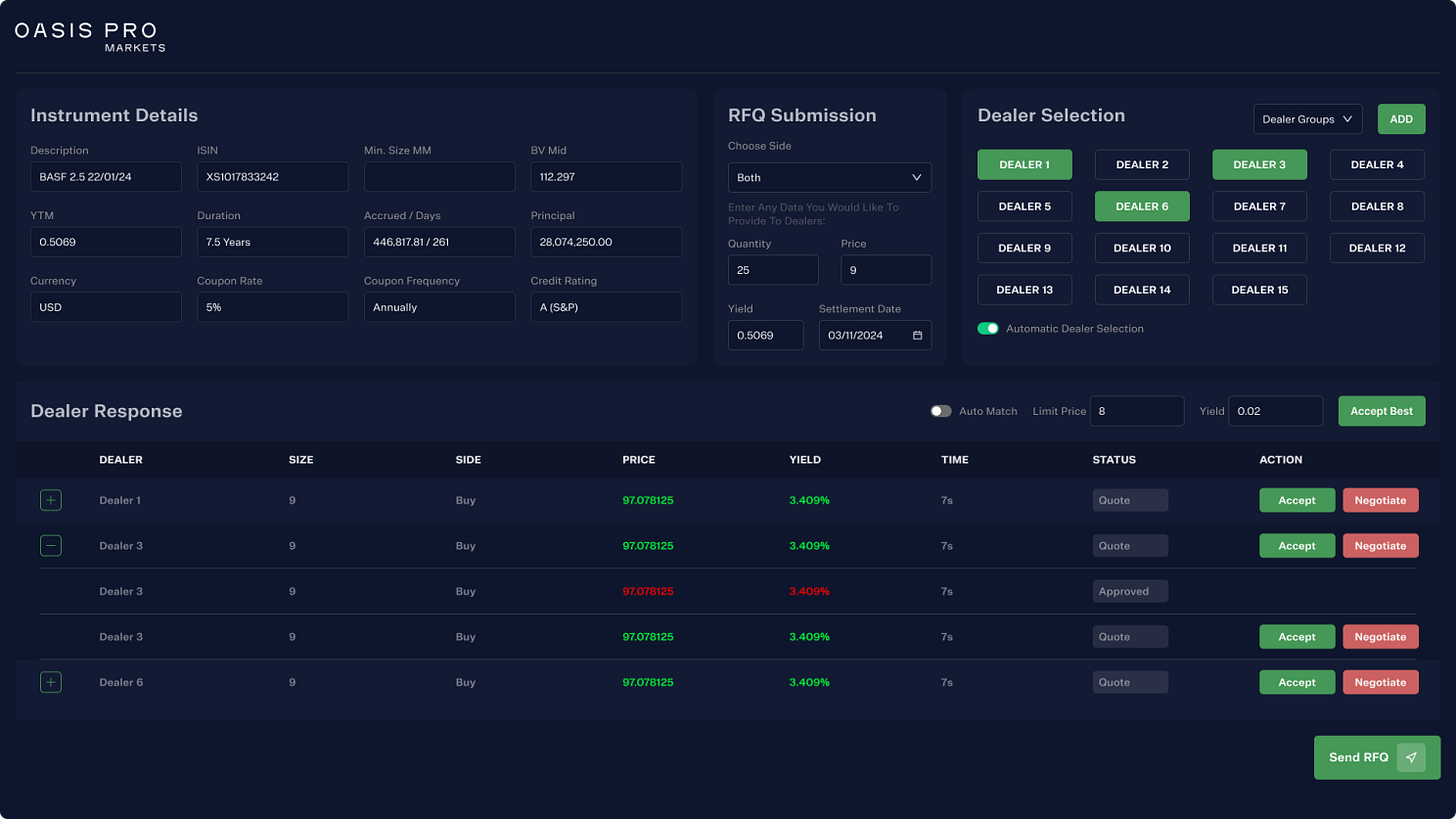

To address this, Ondo leverages its RFQ-based execution on Oasis Pro’s ATS, allowing market makers to quote indicative or executable prices even during nights and weekends. By tapping into participants who are able to manage gap risk and hedge upon market open, the system ensures continued liquidity and robust price discovery around the clock.

Oasis Pro acquisition

On 4 July 2025, Ondo Finance announced that it has signed a definitive agreement to acquire Oasis Pro Markets LLC, a fintech infrastructure provider founded in 2019 and focused on real-world-asset (RWA) securities. Oasis Pro is well positioned because it already holds the three licences needed to form the gold‑standard regulatory stack for digital security offerings in the United States:

SEC‑registered broker‑dealer licence, permitting solicitation, execution, and limited custody of securities transactions;

Alternative Trading System (ATS) registration, authorising secondary trading of tokenised securities settled in either fiat or stablecoins (e.g., USDC, DAI)

Transfer‑agent registration, enabling on‑chain issuance, cancellation, and processing of corporate actions.

For Ondo, which to date has marketed its tokenised treasuries (OUSG, USDY) and forthcoming Global Markets (GM) equity tokens exclusively to non-U.S. investors under Regulation S, the acquisition is a major stepping stone. First, it provides an immediate pathway into the domestic U.S. securities market - once necessary approvals are finalised - allowing Ondo to distribute its fully collateralised GM tokens to accredited, and potentially retail, US investors. Second, it brings vertical integration: owning the broker-dealer, ATS, and transfer-agent functions means Ondo can control the entire lifecycle of a tokenised security, from issuance and primary distribution to secondary trading, settlement, and ongoing share-registry maintenance, without depending on third-party intermediaries.

With Oasis Pro’s licences in-house, Ondo gains the credibility to onboard banks, asset managers, and large brokerage networks that insist on FINRA-supervised infrastructure. It can also broaden its product suite beyond treasuries and foreign-only equities to include U.S. corporate bonds, private equity deals, or even SEC-registered security tokens, each supported by the same regulated rails. While the deal remains subject to customary regulatory clearance, it marks a decisive step toward marrying the programmability of DeFi with the investor protections and market depth of the U.S. capital markets.

Ondo Global Markets and GM Assets

Ondo Global Markets (GM) aims to tokenize over 100 publicly traded U.S. stocks and ETFs into ERC‑20 tokens, fully backed 1:1 by the underlying securities held in custody at a regulated custodian through a licensed broker-dealer. Non‑U.S. investors can mint, transfer, and redeem these equity‑backed tokens on Ethereum and Ondo Chain. Each token is redeemable for its cash-equivalent value, supports cross-chain DeFi integrations, and benefits from Oasis Pro’s SEC‑registered broker‑dealer and transfer-agent services to ensure institutional-grade compliance and security.

What makes Ondo GM fundamentally different is its seamless integration with traditional market liquidity, allowing users to purchase tokenized stocks while preserving the mechanics of real-world execution. For instance, when a user buys onTSLA via Ondo GM:

Stablecoins are used to fund the purchase

A corresponding TSLA share is acquired on NASDAQ

The user instantly receives TSLA in their wallet

By abstracting these steps into a single on-chain experience, Ondo provides immediate access to tokenized stocks that are fully backed and synchronized with traditional exchange activity.

How exactly does it work?

Ondo leverages Oasis Pro’s Request for Quote (RFQ) function which empowers participants to negotiate on the listed prices of specific tokenized assets to enable 24/7 tokenized asset trading. This infrastructure allows whitelisted market makers to submit and respond to trade requests at any time, including nights and weekends, even when the underlying U.S. equity markets are closed. During these off-market hours, the RFQ system plays a critical role in sustaining price discovery where market makers can quote indicative or executable prices.

Importantly, while secondary token trading can occur at all times via RFQ on the ATS, minting and redemption of GM tokens is only processed during a 24/5 window, aligned with U.S. trading hours. This separation ensures that while access and liquidity are continuous, settlement into real-world assets remains grounded in the timing and constraints of traditional financial infrastructure.

Closing Thought

Traditional securities trading frameworks still carry three stubborn frictions: business-hour trading, slow/batch settlement, and fragmented access. The Silicon Valley Bank episode underscored this, when risk unfolded over a weekend, most investors had to wait until markets reopened to act. Tokenization directly tackles those constraints: 24/7 market access, near-instant settlement, fractional ownership and global reach. Just as important, tokenizing stocks makes them composable with DeFi where investors can collateralize stock tokens to borrow working capital or earn yield while keeping exposure to the underlying shares. That unlocks a wider toolkit of basis, carry, and liquidity strategies for institutions.

While tokenized stocks aren't completely new, the early attempts taught hard lessons. Synthetic and exchange-issued “stock tokens” stumbled on unclear custody, weak redemption, and regulatory risk. The market is now maturing with fully-backed issuers, centralized venues, DeFi derivatives, and on-chain liquidity infrastructure are converging into a more credible stack.

Ondo Global Markets reflects this shift with a compliance-first, 1:1-backed model; 24/5 mint/redeem anchored to the cash market; and 24/7 secondary liquidity via RFQ on an ATS among whitelisted market makers with a clear custody and integration points for developers. If spreads stay tight in off-hours, redemptions remain reliable, and DeFi integrations deepen, tokenized equities won’t replace NYSE or Nasdaq but extend them. The result is an upgraded equity rail that moves at instant speed, preserves regulatory trust, and opens the door for institutions to run always-on, collateral-efficient strategies.