Lista DAO — The BNB Chain Super App (PART II)

Staking, borrowing and lending under one roof

In the first part of the article, we examined the design of ListaDAO’s core offerings. The second one focuses on Protocol’s economics, tokenomics, product traction, roadmap and team structure. Let’s dive in!

Protocol Economics

From a financial perspective, the CDP design works as a typical commercial bank. Revenue comes in the form of:

Interest charged on lisUSD loans originated by ListaDAO.

Liquidation penalties are charged when the collateralization level falls below a predefined threshold and the volatile assets are auctioned to bidders. Lista charges a standard 10% penalty.

A 2% fee is charged when users convert lisUSD to USDT in the PSM.

The main expense is in the form of Lista Savings Module, sharing a part of the revenue with the lisUSD holders. Hence, the profitability of the product is a function of the net interest spread and the percent of lisUSD deposited into the module.

Tokenomics – Allocation and veLISTA Governance

LISTA is the governance and utility token of ListaDAO. Its tokenomics are crafted to foster long-term alignment and incentivize active participation. It implements a vote-escrow token model for governance and tokenomics via its veLISTA system similar to Curve Finance’s ve-token framework.

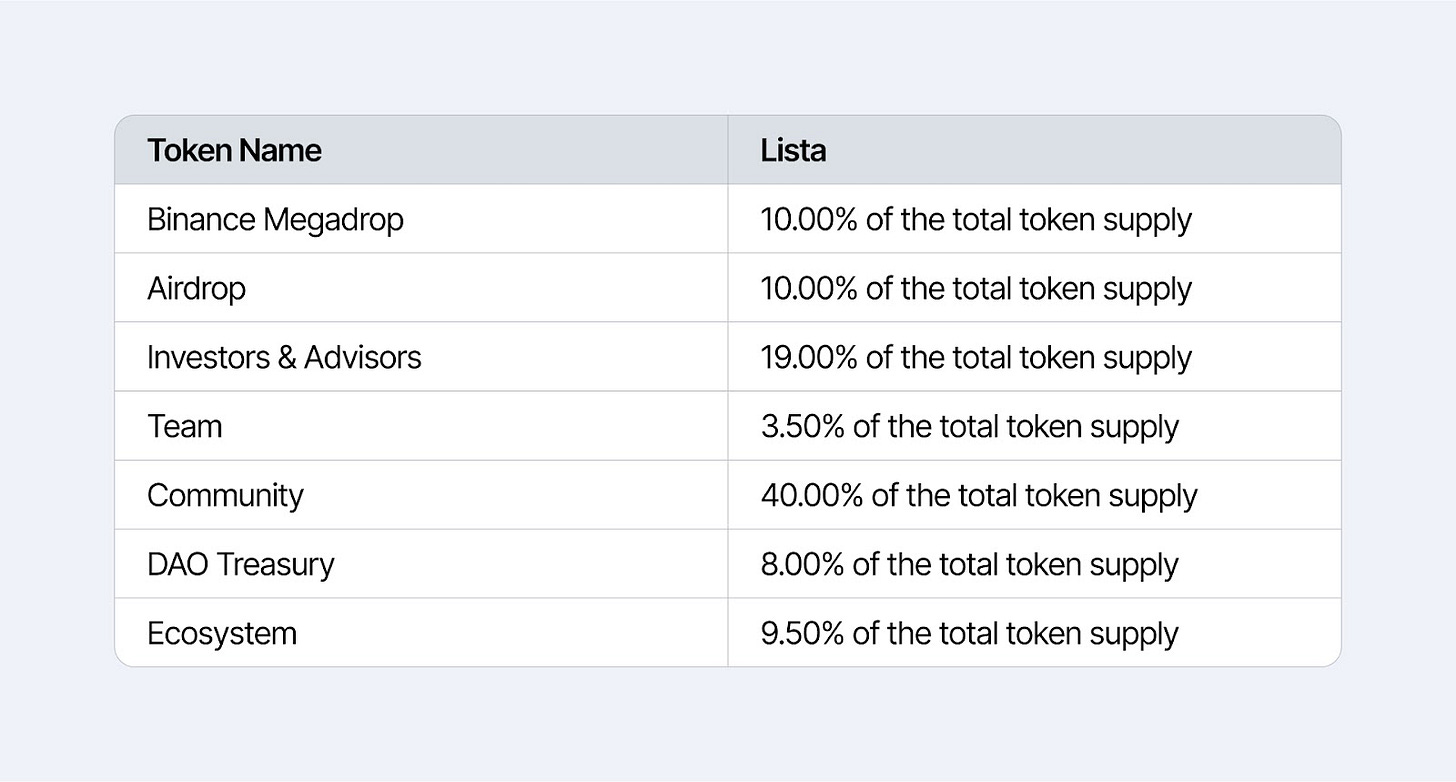

Token Allocation

The total supply of LISTA is fixed at 1 billion, the distribution as follows:

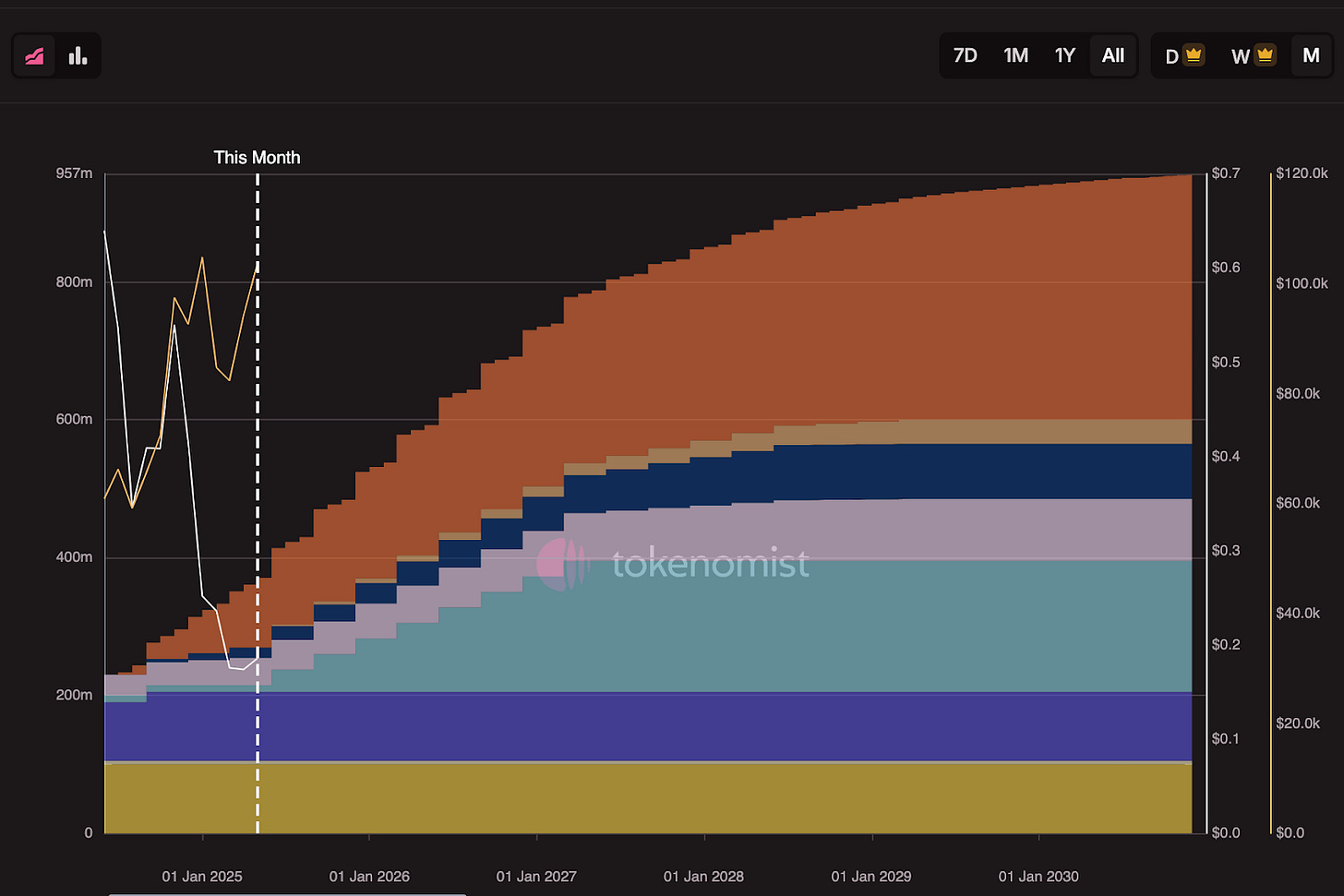

Lista launched its token in June 2024, with a Binance Launchpool “Megadrop” and an early‑user airdrop. Roughly 23 % of the 1 billion‑token supply was immediately liquid at launch, while the remaining 77 % entered long‑term cliffs and vesting schedules.

Lista Governance - veLISTA framework

Users can lock their LISTA tokens (the native governance token) for a chosen duration to mint veLISTA . veLISTA tokens are non-transferable and confer governance rights and increase in rewards - both scaled by locked amount and duration.

veLISTA stakers will receive 30% of the protocol fees in the form of various token rewards, including LISTA emissions, stablecoin/staked asset yields, and fees from the platform. Specifically, veLISTA holders receive distributions of:

LISTA (from the continuous emissions allocated to community incentives).

lisUSD (the protocol’s stablecoin, from borrowing interest fees): 50% of the net protocol fees are passed to the veLISTA holders.

slisBNB & wBETH (yield-bearing assets from the liquid staking module): 50% of the net protocol fees are distributed to veLISTA holders once again.

additional LISTA from early unlock fees.

ListaDAO is governed by its community of token holders where veLISTA holders gain the right to vote on the proposals. Proposals called Lista Improvement Proposals (LIPs) are brought forth for changes like adding new collateral types, adjusting protocol parameters, or allocating treasury funds.

Emissions Allocation and Gauge Voting

ListaDAO’s tokenomics is that veLISTA holders direct where new LISTA token emissions go, through a gauge voting system much like Curve’s. The protocol has set aside a large portion of the total LISTA supply (40% of remaining supply) for community emissions. veLISTA holders collectively vote each week to determine the distribution of these LISTA emissions among eligible pools. The current inflation is set at 250,000 LISTA per week, with a decreasing rate of 1/√2 each year.

Each whitelisted pool or incentive program is considered a “gauge”. veLISTA holders can vote by assigning portions of their voting power to different gauges (e.g. Pool A, Pool B, etc.) during the weekly voting window. At the end of the week, a snapshot is taken of all votes, and the LISTA emissions for the next week are allocated in proportion to the vote weights. The more veLISTA backing a pool, the greater the token rewards that pool will receive.

To prevent manipulation or extreme outcomes, ListaDAO imposes an emission cap per pool – even if a whale votes a huge amount to one pool, there’s a limit to what share of emissions any single pool can get, ensuring a more balanced distribution of incentives.

This dynamic allocation means the token’s emission rewards flow to where ve- holders perceive the most value, aligning liquidity mining with governance decisions. Additionally, it opens the door for a bribe market, where external protocols may offer incentives (bribes) to veLISTA holders to vote for their pool.

Current State and Performance (June 2025)

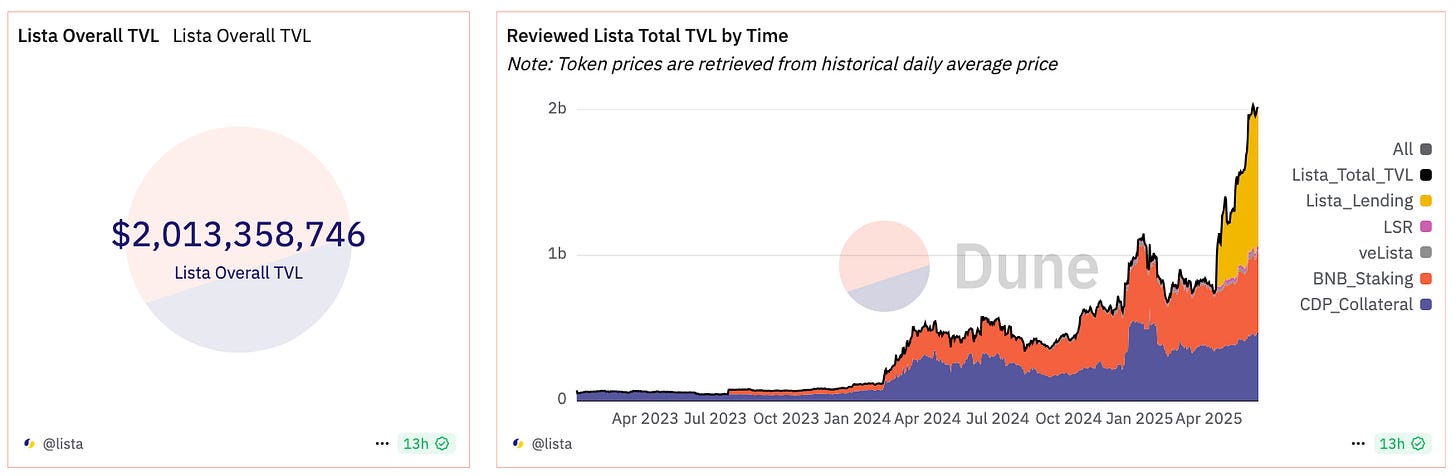

As of today’s writing 4 June 2025, Lista DAO has solidified its position as a leading DeFi protocol on BNB Chain, boasting a Total Value Locked (TVL) of approximately $2 billion across its core products: liquid staking, lending, and stablecoin modules .

slisBNB: ListaDAO's liquid staking token, slisBNB, has emerged as the dominant liquid staking asset on BNB Chain, commanding a TVL of $550 million, which accounts for nearly 99% of the liquid staking market share on the network.

Lista Lending has achieved a TVL of $588 million. This positions Lista Lending as the second lending protocol on the BNB Chain.

lisUSD: ListaDAO's over-collateralized stablecoin, lisUSD, currently has a circulating supply of approximately $64.2 million, backed by collateral assets totaling around $476 million, with a collateralization ratio of roughly 1,100%.

For a clearer view of yield sources and major stakeholders.

slisBNB offers an aggregate yield of ~16.56 % (15.68 % Launchpool yield + 0.89 % liquid staking yield) on about 794,000 BNB staked. Currently, three major liquid-staking protocols operate on BNB Chain — Stader (BNBx), pSTAKE (stkBNB), and Lista’s slisBNB. The combined BNB staked across these protocols is roughly 798,000 BNB, giving slisBNB nearly 99 % market share in this segment.

The slisBNB ledger is dominated by three protocol-owned contracts that together hold about 86 % of the circulating supply. The largest wallet, GemJoin, holds 53% of all slisBNB (~$285 million); it is the CDP adapter for user deposits and serves as active collateral for lisUSD, so every token there directly backs outstanding stable-coin debt. The second-largest balance with 29% of total slisBNB supply(~$155 million), sits in the SnBnbYieldConverterStrategy contract, an auto-compounding restaking strategy that recycles validator rewards into a growing insurance buffer for the DAO. A further 6% (~$34 million) is parked in the Moolah liquidity-management vault, which seeds PancakeSwap’s slisBNB-BNB pool and other venues. In essence, most slisBNB is not in passive wallets but locked into collateral, restaking, or liquidity-provision.

Lista Lending’s TVL breaks down into two components: $364 million in deposits and $588 million in collateral. Notably, the Lista USDT vault offers the highest APY at roughly 14.6 % (5.87 % native rate + 8.7 % LISTA emission rewards) and holds about $17.67 million in USDT.

On the CDP side, the protocol has minted roughly $63 million of lisUSD in total, yet only about $41 million remains as outstanding debt, meaning the remaining $22 million worth of lisUSD was repaid (or burned via liquidations).

Zooming in on lisUSD distribution: roughly 39 % of all lisUSD (~24.5 million) sits in the Savings Module; 20% (~12.8 million) in PancakeSwap stableswap pool; and about 8% (~5 million) resides in the PSM as 1-for-1 swap liquidity against USDT. The remaining 33 % is dispersed across 29,000+ wallets, likely held by whales or individuals participating in LP farms or depositing into other money-markets.

ListaDAO operates three validators on the BNB network, collectively accounting for roughly 800,000 BNB. Currently, these validators participate as Candidates, meaning they serve as backups, ready to replace Cabinet validators (active validators producing blocks) when needed.

Roadmap

With core architecture shipped in ’24, 2025 shifts from build-out to expansion. ListaDAO opens 2025 with a clearly sequenced roadmap. The team plans to activate the full veLISTA governance stack, deepen lisUSD’s cross-chain footprint, upgrade slisBNB’s staking infrastructure, and expand the BNBFi ecosystem through permissionless, curator-led lending markets.

With a full roll-out of veLISTA voting emissions:

higher-weight emission boosts

discounted lisUSD borrowing

open-market LISTA buy-back program funded from protocol revenue

48-hour liquidation protection and other tiered perks (coming soon)

Pillar 1 – lisUSD expansion (Lista 1.0).

lisUSD is now scheduled for a multi-chain rollout to accelerate uptake. The DAO will pilot two borrower incentives: fixed-rate “promo” vaults capped by TVL and limited free-borrowing windows tied to veLISTA votes, both aimed at boosting user engagement, driving protocol revenue, and attracting additional liquidity.

Pillar 2 – slisBNB enhancements (Lista 2.0).

On the staking side, the roadmap calls for a deeper validator set, the protocol will spin up a constellation of smaller nodes, reducing single-operator risk and opening the door for delegated-validator governance. This pushes the staking layer toward better decentralization and higher yield reliability, ensuring a sustainable staking experience for users.

Pillar 3 – BNBFi & cross-chain LSD collateral (Lista 3.0).

The clisBNB certificate is slated to become the hub of a broader “BNBFi” strategy. Through bridges and strategic swaps with StakeStone, Solv, and other LSD aggregators, Ethereum-based staked assets (e.g., stETH, ezETH) will be wrapped and rehypothecated into BNB-denominated certificates that can farm Binance Launchpool, Megadrop, or Hodler rewards.

Lista DAO also plans to roll out cross-chain vaults designed to capture incentives and airdrops on several networks. A new referral program will be launched for influencers and KOLs to bring in additional users and speed up adoption.

Team

ListaDAO combines experienced Web3 builders and traditional-finance veterans includes:

Terry Huang — Chief Operating Officer & Co-Founder

Previously Country Manager at Binance, Terry specialised in strategic operations and market expansion.Lorena — Business Development Lead

Former BD Manager at Binance; she drives business development and strategic partnerships to grow the Lista DAO ecosystem.Bob — Product Lead

Former product lead of Binance NFT market; he focuses on product development and optimisation at Lista DAO, ensuring offerings stay ahead of industry trends.Kay — Marketing Manager

With prior marketing experience at a crypto-wallet protocol, Kay handles marketing at Lista DAO to keep the brand competitive and resonant with its target audience.Helen — Operations Manager

Former community manager at an exchange; Helen now oversees operational matters at Lista DAO to ensure the organisation runs smoothly and efficiently.

Final Thought

Lista DAO follows a deliberately modular blueprint in which each product both finances and protects the next. At the base layer, slisBNB converts validator income into a non-rebasing token whose exchange rate rises automatically; 95 % of gross yield flows straight to holders, while the remaining 5 % funds insurance and buy-backs. Because slisBNB is non-rebasing, it can sit inside contracts without accounting drift — an under-appreciated but critical design choice that lets the token operate as pristine collateral.

ListaDAO shows what happens when a liquid-staking token, an over-collateralized stablecoin, and a curator-driven lending layer are wired into a single feedback loop.

The next chapter for Lista DAO is governance-led. Once veLISTA gauges, cross-chain lisUSD, and a delegated validator set are fully activated, debt ceilings, oracle mixes, and emission weights will update block by block through on-chain votes rather than multisig signatures. If execution aligns with ambition, Lista DAO is poised to become BNB Chain’s institutional-grade liquidity hub—delivering a yield-bearing stablecoin, a compounding staking token, and a lending layer that rebalances itself in real time.