Lista DAO — The BNB Chain Super App (PART I)

Staking, borrowing and lending under one roof

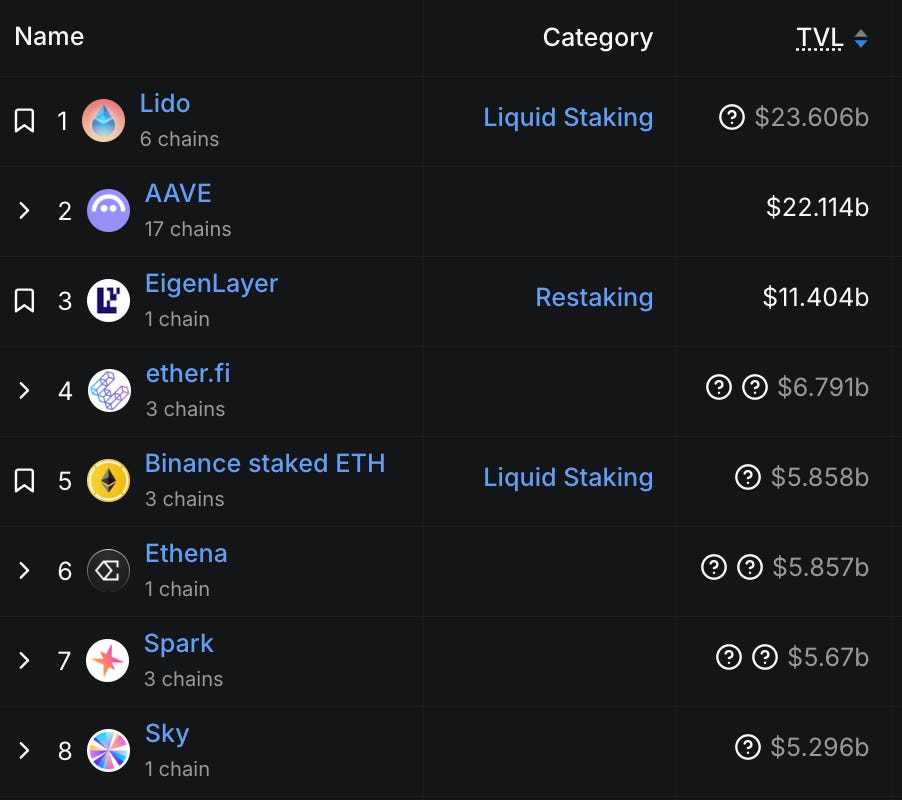

Today, in the Total-value-locked (TVL) distribution on Ethereum, there are four core DeFi primitives attracting the majority of on-chain assets: liquid staking and restaking tokens issued by Lido and ether.fi, Aave’s lending-borrowing marketplace and Sky (formally MakerDAO) – the first and largest collateralized debt position (CDP) stablecoin.

MakerDAO introduced the term Collateralized Debt Position (CDP) when it launched in 2017 as the first decentralized protocol to allow users to mint a stablecoin (DAI) against on-chain collateral. The model is straightforward: a user deposits $1 million worth of eligible crypto collateral to receive up to $700,000 worth of credit line in algorithmic stablecoins at a fixed interest rate and with flexible repayment terms. If the collateral value falls below a predefined threshold, an automated liquidation mechanism auctions the assets to preserve the peg and avoid bad debt accumulation.

From the end-user's perspective, the product offers an intuitive and user-friendly experience: compared to the lending/borrowing marketplaces like Aave or Morpho, which use variable interest rates based on utilization curve, cross-collateral pools, and are subject to liquidity constraints, overcollateralized stablecoin protocols offer simplicity and predictability.

In February 2022, Aave — the largest money market in DeFi — voted to support stETH in its lending pools. In essence, it opened the doors to yield-bearing collaterals and a new chapter in crypto lending.

MakerDAO’s adoption of wstETH extended this concept to CDPs, enabling DAI borrowers to benefit from Ethereum’s staking yield while maintaining over-collateralization. This industry-wide innovation — often dubbed “LSDfi” (Liquid Staking Derivative Finance) — created a new class of stablecoins backed by interest-accruing assets. It demonstrated that a stablecoin’s collateral could be productive, and not merely idle capital in a vault. The result was a more capital-efficient lending market, effectively lowering the borrowing rate as yield from staked collateral continuously bolsters the system’s stability and attractiveness to borrowers.

In these two-series articles, we will explore ListaDAO, a leading DeFi protocol on BNB Chain that integrates liquid staking, an over-collateralized stablecoin, and P2P lending marketplace. We dive into its protocol architecture, CDP design, lisUSD peg mechanisms, staking infrastructure, token distribution, governance model, and overall performance.

The Growth Story

Lista DAO (originally Helio Protocol) launched on BNB Chain in mid-2022 with a simple Maker-style architecture. The protocol accepts collateral assets such as BTCB, ETH, and BNB liquid-staking tokens like Ankr’s ankrBNB as CDP collateral to borrow HAY.

Merger with Synclub and Rebrand to ListaDAO

In mid-2023, Helio took strategic steps to reinforce its platform. They announced a merger with Synclub, one of the largest BNB staking validators. By combining Synclub’s staking infrastructure with Helio’s stablecoin system, the project could natively stake user deposits across a basket of BNB liquid staking tokens including AnkrBNB (Ankr), snBNB (Synclub), BNBx (Stader), and stkBNB (pSTAKE) to diversify risk. This strategic step was followed by Binance Labs expressing confidence in this direction with a $10M investment to accelerate Helio’s LST-fi pivot.

The integration paved the way for the rebrand. After several months of restructuring, Helio Protocol underwent a formal rebrand to ListaDAO with a revamped platform and announced future governance token ($LISTA). Along with the rebranding, core products were renamed: Helio’s HAY stablecoin became lisUSD, and Synclub’s staking token SnBNB was unified into slisBNB. This rebirth was more than cosmetic – it introduced product architecture improvements reflecting lessons learned from a 2022 exploit and industry best practices.

ListaDAO implemented a resilient triple-oracle system to ensure redundant and tamper-resistant price feeds. It adopted isolated vaults for different collateral types and markets, so that any risk or volatility in one collateral pool would not compromise the entire system. This vault isolation, combined with more granular risk parameters per asset, provides effective risk segmentation in the protocol. In essence, post-merger ListaDAO evolved into a modular stablecoin platform with improved safeguards, aiming for both capital efficiency and resiliency.

Protocol Design

ListaDAO is an integrated DeFi suite on BNB Chain, built around three core pillars: yield-bearing liquid staking token (slisBNB), over-collateralized stablecoin (lisUSD), and P2P lending platform (Lista Lending). Together, these components turn Lista DAO into a standalone super app on the BNB Chain.

Liquid Staking - slisBNB

slisBNB is ListaDAO’s native, yield‑bearing liquid‑staking token for BNB. When a user delegates BNB through the protocol, the tokens are routed to Synclub‑operated validators; in return the staker receives slisBNB, a freely transferable ERC‑20 that represents both principal and accrued rewards.

slisBNB is non‑rebasing, the wallet balance never changes — instead its exchange rate versus BNB rises as validator rewards are compounded (equivalent to Lido’s wstETH). Of each reward epoch, 95 % of the staking yield is passed through to holders, while 5 % is directed to the treasury and insurance reserve. slisBNB benefits from multiple DeFi integrations:

Collateral in Lista vaults – lock slisBNB to mint lisUSD, leveraged looping, or combine with clisBNB for dual‑yield strategies.

Collateral on Euler via K3 Capital BNB Yield Hub – supply slisBNB into Euler and borrow WBNB, or loop it for more slisBNB rewards.

Fixed-income trading on Pendle – deposit slisBNB to mint PT and YT tokens; keep the PT side for principal exposure or hold the YT side to capture launchpool rewards.

Liquidity provisioning – supply to the Thena Finance or PancakeSwap slisBNB‑BNB pools; deep liquidity tightens the slisBNB ↔ BNB peg and earns LP trading fees plus external incentives.

Restaking via Aster, Kernel, Binomial or Karak – delegate slisBNB to external trust networks, collecting additional security‑fee rewards without relinquishing the base staking yield.

With validator income, LP fees, structured‑product coupons, and restaking commissions all accruing simultaneously, slisBNB functions as the multi‑yield base layer of the ListaDAO stack.

Binance Launchpool Certificate - clisBNB

clisBNB is ListaDAO’s non-transferable certificate token, minted either by BNB or slisBNB by participating into Lista CDP or Lista Lending. Depositing BNB to mint clisBNB at a 1:1 ratio, while depositing slisBNB mints approximately 0.9709 clisBNB per 1 slisBNB. The token lets users participate in Binance Launchpool while their BNB remains staked via slisBNB — no unstaking or CDP closure required.

Once acquired, clisBNB can be held in a Binance Web3 MPC wallet to earn Launchpool rewards off-chain while continuing to back a lisUSD CDP on-chain.

Alternatively, to capture clisBNB’s binance launchpool rewards, users may:

Provide liquidity to the BNB/slisBNB pool on Thena and stake the LP tokens to earn clisBNB.

Split clisBNB into PT and YT via Pendle:

PT-clisBNB represents a fixed-income position, redeemable at maturity at a 1:1 value for BNB.

YT-clisBNB receives all future validator and Launchpool rewards until maturity.

What makes clisBNB useful?

Launchpool farming without unstaking – Park the certificate in a Binance Web3/MPC wallet; it satisfies the “staked BNB” check while your original BNB keeps earning on-chain validator yield through slisBNB and securing a lisUSD CDP.

Hard-pegged supply control – clisBNB is automatically burned when the underlying BNB or slisBNB is withdrawn, so certificate supply can never exceed collateral.

Custody-friendly issuance – The delegate field at mint lets treasuries, trading desks, or yield aggregators route clisBNB straight to an operational wallet, avoiding manual transfers and saving gas.

DeFi collateral – clisBNB (or its Pendle PT version) is whitelisted in Lista Lending; users can borrow additional liquidity without touching their validator stake.

In other words, slisBNB is a freely transferable liquid-staking token that continuously accrues validator yield on-chain, whereas clisBNB is a non-transferable 1:1 certificate “wrapper” for BNB/slisBNB that captures Binance Launchpool rewards.

CDP - lisUSD Mechanics

lisUSD is Lista DAO’s decentralized stablecoin, 1:1 pegged to USD by overcollateralization and price stability module. Users mint lisUSD by depositing collateral assets into a vault and borrowing against them, maintaining an over‑collateralized position at any time. ListaDAO supports a range of assets. “Classic” collateral options including:

BNB, ETH, BTCB

Lista’s staked BNB token (slisBNB)

liquid-staked ETH tokens (wBETH, wstETH)

major fiat-backed stablecoin (USDT, FDUSD).

Each collateral has specific risk parameters (minimum collateralization ratio, debt ceiling, and stability fee). If a position’s collateral value falls such that its Loan-to-Value exceeds the allowed threshold, it becomes subject to liquidation to keep the system solvent.

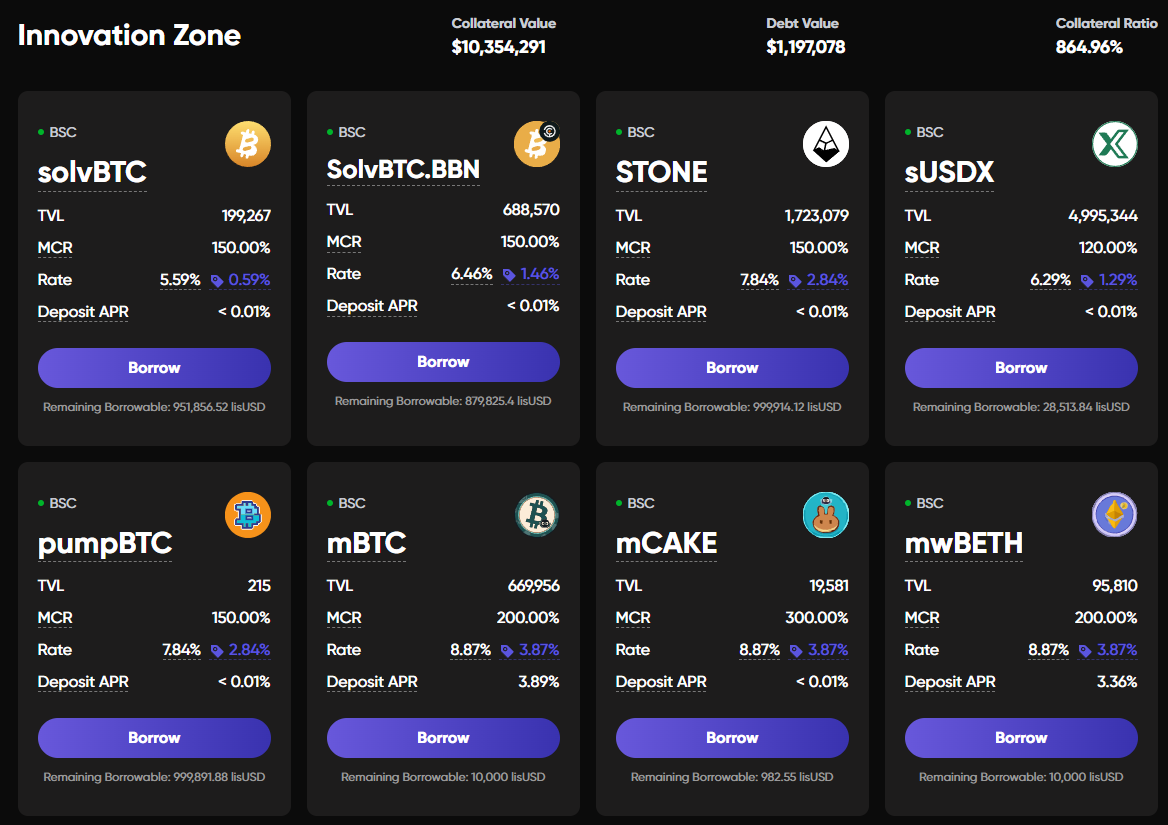

Innovation Zone

Lista introduced an Innovation Zone for collateral that is potentially riskier. Established assets remain in the Classic vaults with standard parameters, whereas newer assets are added to Innovation vaults with more stringent risk parameters.

Innovation Zone collaterals carry higher minimum collateral ratios and low debt ceilings. This ensures any failure of a nascent collateral is isolated and cannot undermine lisUSD’s overall backing.

lisUSD peg Management Stack

The lisUSD peg to the US dollar is maintained through a multi‑layer “peg‑management stack” including:

Peg Stability Module (PSM)

PSM is a buffer where users can trade lisUSD in and out of USDT and USDC at a fixed 1:1 ratio. However, the caveat is that ListaDAO charges a fixed 2% redemption fee when users trade out of lisUSD. Hence, the lower bound of lisUSD is $0.98, creating an arbitrage profit if it trades at a deeper discount. Deposits into the PSM are set at zero fees, meaning that arbitrageurs can swap it for USDT through the PSM and sell lisUSD on the secondary market to put a hard peg at $1 and increase the buffer as a result. USDT holders will be interested in depositing funds into the PSM due to the profit sharing mechanism.

Lista Savings Rate (LSR)

Lista Savings Rate (LSR) is the protocol’s interest-bearing pool for lisUSD, similar to MakerDAO’s DAI Savings Rate. Holders may stake up to 30 million lisUSD and receive a fixed, governance-determined yield that accrues continuously and compounds into their balance.

The mechanism serves two purposes:

Income for depositors, yield is paid in lisUSD and credited to each block, allowing participants to earn a stable return without leaving the ecosystem.

Peg supports, because staked lisUSD is removed from circulation, a higher LSR rate can draw excess supply off the market when the price softens; conversely, the rate can be reduced when additional liquidity is needed.

Deposits and withdrawals are open at all times (subject to pool liquidity, with a 14-day buffer if the cap is fully utilised). By coupling a capped deposit limit with an adjustable rate, the LSR gives governance a straightforward tool to manage demand while providing holders with predictable yield.

Algorithmic Market Operations (AMO) — auto adjusting borrow cost

AMO is an on-chain module that sets a real-time stability-fee APR for every lisUSD vault similar to Curve Finance’s MonetaryPolicy contracts for crvUSD. lisUSD uses real-time price data through Binance Oracle to:

Raise the APR (up to 20 %) whenever lisUSD trades below $1, making borrowing expensive and encouraging CDP repayment.

Slides the APR back toward 0 % when lisUSD trades at or above $1, cheapening new debt and expanding supply.

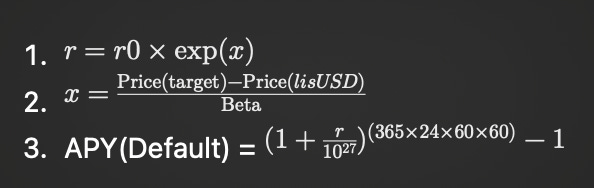

The borrowing interest rate (r) is calculated as follows:

Each collateral has its own governance-set base rate r and a price-gap factor Beta.

In plain terms, for every 1% that lisUSD strays from its $1 target, the per-second borrowing rate is multiplied by e^{±(1 % / β)}, where β is a protocol-set “sensitivity” parameter. The rate refreshes every 15 minutes or immediately when anyone borrows or repays so even brief price moves will lead into a higher or lower cost of debt.

Initially, the Lista core team will set the parameters based on market dynamics. Any subsequent changes will require a formal proposal and a community vote.

To preserve peg stability during periods of exceptional volatility, the protocol maintains a discretionary safeguard that is intended solely for short-term risk management and is executed under strict internal guidelines, retaining the flexibility to respond to significant market fluctuations and adapt to fast-moving conditions without a snapshot proposal.

Direct Deposit Module (D3M) — how Lista “pipes” lisUSD liquidity into external money markets

D3M is an on-chain hook that lets the protocol mint or burn lisUSD directly into whitelisted lending pools (starting from Venus) within a 2.5 million-lisUSD ceiling.

When the external borrow rate on Venus spikes signalling unmet demand, D3M mints fresh lisUSD and supplies it to the pool, instantly lowering the rate and restoring peg buy-side pressure.

When demand cools and the rate compresses, the module withdraws (and burns) the excess lisUSD, preventing unwanted expansion.

All interest earned on the deployed balance flows back to the DAO treasury, turning peg defence into a revenue line-item.

The concept is similar to MakerDAO’s D3M inrwgration with Aave, the contract that continuously feeds DAI into Aave V3 when the borrow APR rises above a target spread. Lista applies the same mechanism to BNB-Chain venues, ensuring lisUSD liquidity remains abundant wherever users actually borrow.

D3M gives the DAO a real-time, cross-platform “relief valve” that caps external funding costs without relying on manual intervention. It also acts as a great distribution channel for lisUSD.

Lista Lending

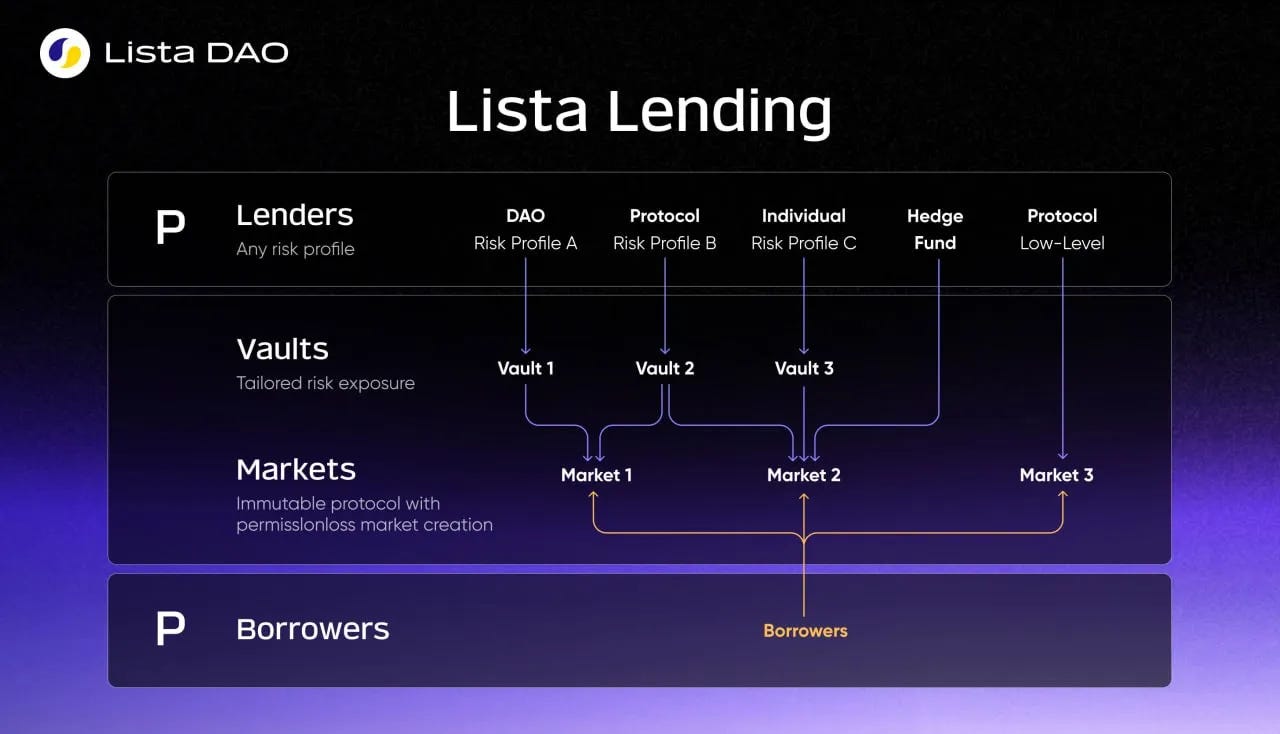

Lista Lending was introduced in April 2025 as ListaDAO’s next-generation money market protocol, inspired by Morpho's peer-to-peer (P2P) lending architecture.

Lista Lending operates through multiple segmented markets, each independently optimized, thus effectively containing systemic risk and offering granular control to participants.

Lista Lending implements several systems that set it apart from competitors, including:

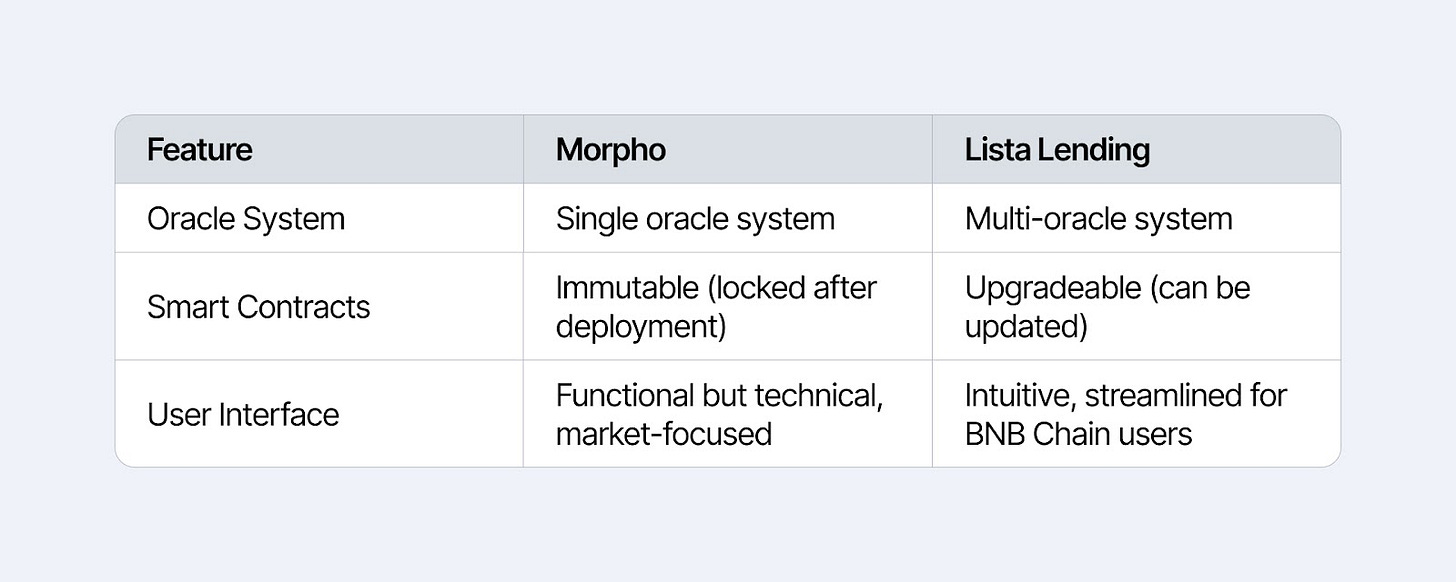

Multi-Oracle System: Every market pulls price feeds from four independent providers (Chainlink, Binance Oracle, API3 and Redstone). Having several feeds lowers manipulation risk, unlike Morpho’s single-oracle setup.

Upgradable Smart Contracts: The code can be upgraded after deployment to patch bugs or add features (rely on the core team’s multisig for upgrades).

Permissionless Market Creation (curation model): Anyone can launch an isolated pool and choose its oracle, collateral list, LTV caps and governance rules. That lets the platform curate risk at the pool level.

Risk-isolated architecture. Each pool is siloed: if one market becomes insolvent, it cannot drain liquidity or collateral from others. Parameters such as interest curve, collateral mix, and max LTV are tuned on a pool by pool basis.

Peer-to-peer matching. Borrowers are matched directly with lenders (as in Morpho), narrowing the spread between supply and borrow rates. Lenders earn more, borrowers pay less and the system’s capital is used more efficiently.

The Lista Lending user flow involves three main roles: lenders, borrowers, and vault curators.

Lenders deposit funds into isolated lending pools matching their risk profiles to earn interest on their assets.

Vault curators launch customized markets with tailored risk settings, accepted collateral, interest rates, and oracle preferences.

Lenders deposit funds into isolated lending pools matching their risk profiles to earn yield.

Borrowers deposit collateral into selected pools and borrow assets, managing their positions with clear indicators for rates and risk parameters.

Interest rate Model (IRM)

Lista Lending relies on the AdaptiveCurveIRM—an interest-rate model tuned for capital efficiency in its vault-based markets on BNB Chain. Adapted from Morpho’s mature framework, the curve automatically raises or lowers the borrow APR to keep utilisation (borrowed ÷ supplied) hovering around the 90 % sweet spot. Because the vault contracts are upgradeable, the IRM can be fine-tuned over time and readily supports looped strategies such as pt-clisBNB leverage, making it a natural fit for Lista DAO’s modular stack.

Rather than a single, static-rate pool, each isolated market inside a vault runs its own AdaptiveCurveIRM instance. This gives pool curators granularity to calibrate parameters for different assets, while borrowers and lenders benefit from competitive rates.