Fueling the InfraFi Market

The boom of Bitcoin led to a massive debt market, with somewhere between $20-50 billion used to finance Bitcoin-related infrastructure. Large Bitcoin mining operations require upfront capital to obtain and deploy efficient mining rigs. The immense demand for capital relied on international debt markets to scale infrastructure, but was slowed due to the lack of appetite for Bitcoin infrastructure as collateral.

Today, the rise of AI marks the emergence of another infrastructure-heavy industry. As AI continues to expand into everyday workflows, experts from McKinsey project over $5.2 trillion in capital expenditure on AI processing infrastructure by 2030. GPUs, data centers, and inference networks are now key pieces of the new digital economy, but traditional debt markets are not able to keep up with the compounding demand for computing power.

USD.AI addresses this issue by offering on-chain private loans collateralized by infrastructure hardware. By bridging existing on-chain liquidity with infrastructure operators, USD.AI enables scalable access to capital without relying on centralized counterparties. Both parties benefit greatly as on-chain yield products gain access to RWAs that undergo robust collateralization and risk management measures, while infrastructure operators can leverage their debt to meet computational needs.

The Economics of the GPU Business

USD.AI offers loans to borrowers willing to use their hardware as collateral, but what economic incentives are borrowers chasing that make this debt preferable? Let’s step into the shoes of a potential borrower to see what the profitability of supplying computing power looks like.

A borrower must consider why renting out GPUs is profitable in the first place and how long the opportunity will last. As stated previously, the boom of AI has led to a massive demand for high-end GPUs needed to train and operate AI models. NVIDIA has a near-monopoly over AI-focused computing power, making up around 92% of the market according to AInvest. NVIDIA’s CUDA ecosystem has the widest developer support, making the switch to competitor GPUs difficult. However, NVIDIA GPUs are still limited in supply, thus driving up the prices to rent a NVIDIA GPU from a datacenter. The AI boom is still occurring, with 40% of venture capital investments going towards AI startups last year, according to CNBC. The global data center GPU market size is expected to increase at an average of 35.8% YoY, as per Grand View Research. With the expectation of an increase in demand, it is reasonable to conclude that renting out GPUs will remain profitable for the foreseeable future. However, there are some factors that could make a GPU investment potentially unprofitable. The rise of custom computing chips such as Trainium from AWS, or the Tensor Processing Unit from Google, could cut into the market share of NVIDIA GPUs. NVIDIA has taken steps to protect its market share by launching NVLink Fusion, a connection technology that allows third-party CPUs and custom chips to integrate into AI systems alongside NVIDIA GPUs. While these chips don't run CUDA directly, they can share memory and data with CUDA-running GPUs — effectively participating in the CUDA ecosystem, but on NVIDIA’s terms. Additionally, if the supply of GPU computing power grows faster than the demand, the profitability of renting out GPUs could decline.

USD.AI Protocol Overview

The USD.AI ecosystem is comprised of two synthetic dollar tokens: USDai and sUSDai. These two tokens help fuel the modern need for computing by allowing computational hardware and other infrastructure to be used as collateral in loans. This enables USD.AI depositors to get an exceptional return on their capital by providing the necessary capital to an imbalanced supply/demand market.

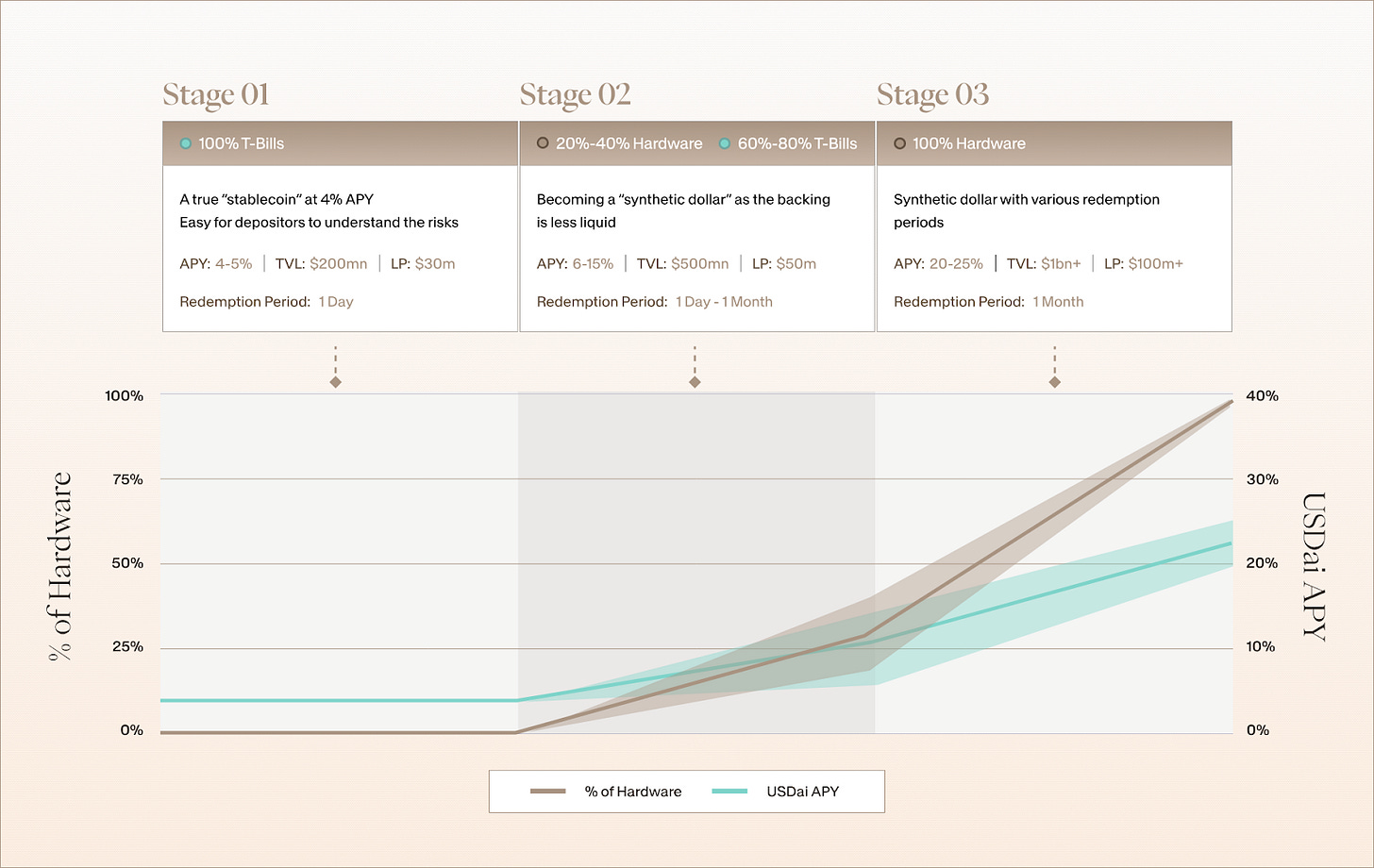

USDai is a low-risk, synthetic token backed by $M, which does not receive yield, but is instantly redeemable at all times. sUSDai is the staked counterpart to USDai, which receives yield generated through T-bills and loans, but is subject to redemption periods.

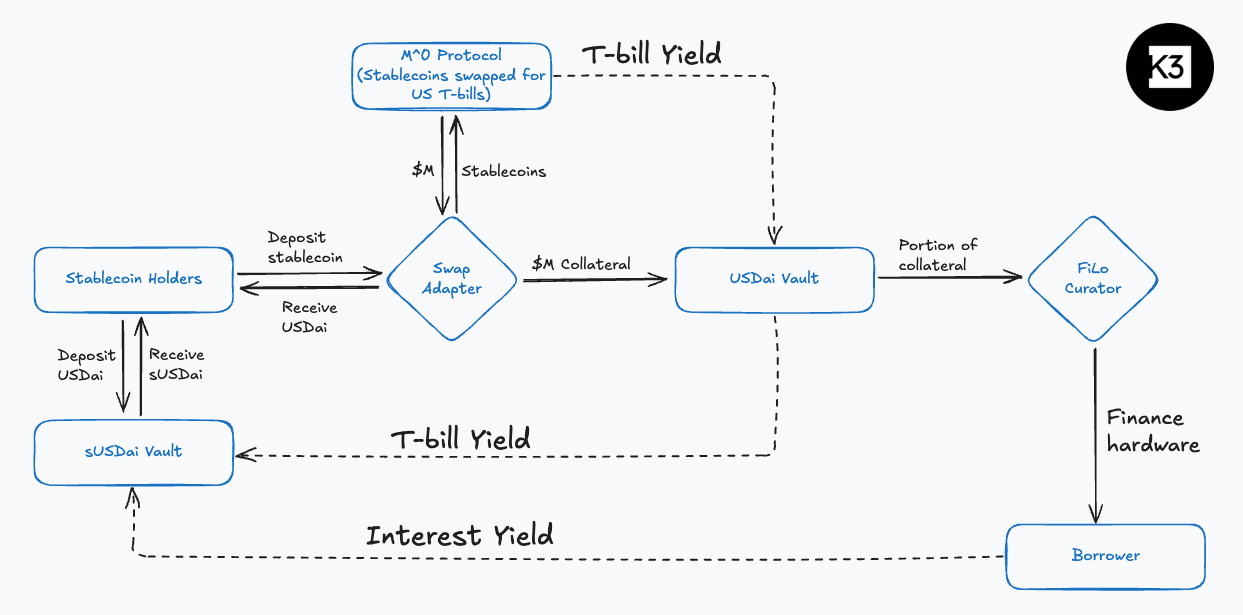

Here’s a high-level overview of how funds flow in the USD.AI ecosystem:

Users can deposit accepted stablecoins into USD.AI to receive the USDai token. These stablecoins are swapped for the $M token, which is backed by tokenized US T-bills (USTB). The yield from these underlying US T-bills flows into the sUSDai vault. USD.AI adjusts the portion of collateral dedicated to financing infrastructure versus US T-bill, depending on the protocol’s TVL. Collateral used to finance infrastructure utilizes a tech stack of the Collateralization Registry System (CALIBER), First Loss (FiLo) Curator, and Queue Extractable (QEV) to maintain protocol liquidity and gain yield. Borrowers utilizing funds from USD.AI pay an interest rate, which is directed into the sUSDai vault.

The portion of collateral dedicated to financing infrastructure is split into stages, each with a target total-value-locked (TVL). As TVL grows and more of USDai’s backing becomes hardware, the redemption period grows due to hardware assets naturally being less liquid than short-term T-bills.

CALIBER

CALIBER (Collateralized Asset Ledger: Insurance, Bailment, Evaluation, and Redemption) is a framework that connects off-chain and on-chain assets through Uniform Commercial Code Section 7. This new framework offers many advantages over traditional RWAs. Traditional RWAs typically do not allow for the direct ownership of an asset. Instead, they typically represent the income from an asset through SPV-based claims. Under CALIBER, each asset has 1:1 direct ownership through an ERC-721 NFT, which serves as a tokenized document of title and allows legal ownership of the off-chain asset. This facilitates a faster default process and the ability to use off-chain assets as collateral on-chain through the NFTs.

On-Chain GPU Collateralization

It is worth noting that initially, USD.AI will focus on using lending to tokenized GPUs. However, this framework can be applied to many types of infrastructure hardware.

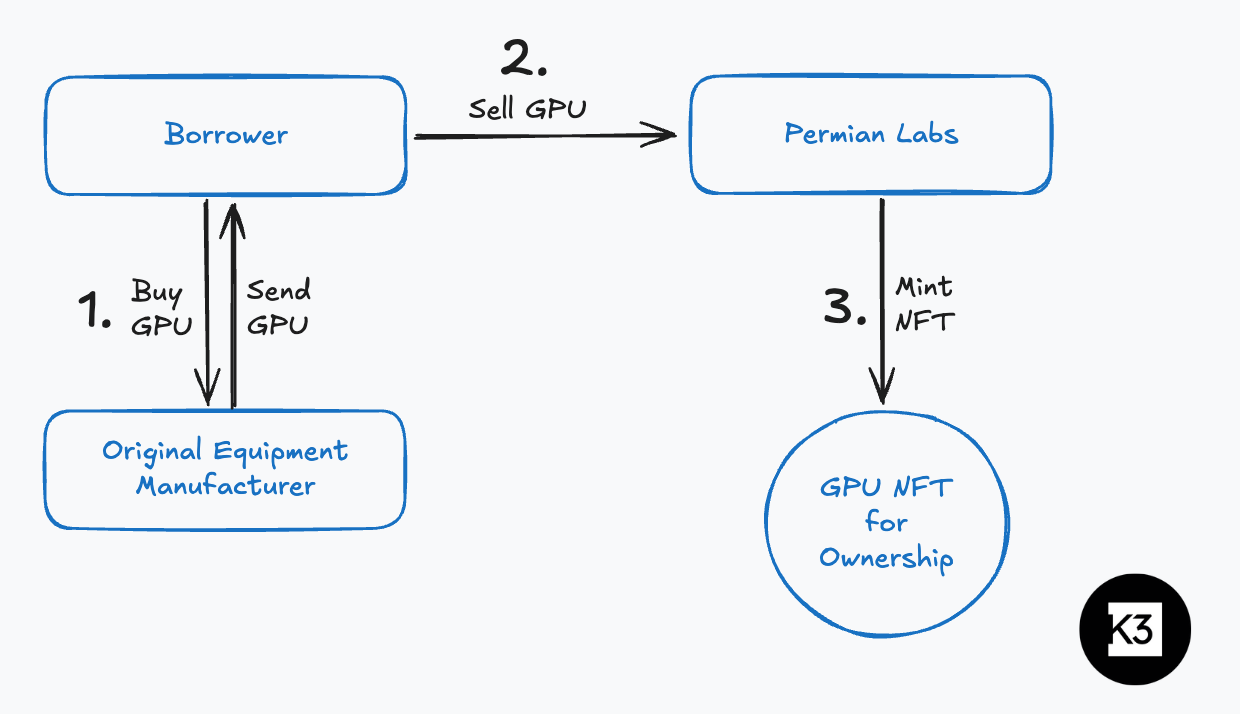

Step 1: GPU Tokenization

After a borrower obtains their GPU, they sell it to Permian Labs, who then tokenize it by minting an ERC-721 NFT. Whoever is the owner of the NFT retains full legal ownership of the underlying GPU, meaning the NFT can be transferred on-chain to change ownership of the GPU. To help ensure the underlying GPU retains a fair value, Permian Labs conducts due diligence on the borrower. The borrower must pass requirements such as proof of insurance, a physical site visit, and lien clearance.

In conjunction with the tokenization of the GPU, a bailment contract is executed between the borrower and Permian Labs. This allows the borrower to maintain full operations of the GPU while Permian Labs remains the legal owner of the GPU by holding the GPU NFT. After the GPU collateral is installed and verified by Permian Labs, the borrower is transferred the GPU NFT to be used as loan collateral.

Due to the nature of hardware, there is a lag time between the purchase of a GPU and when it is cleared to be collateral for loans. During this lag time, sUSDai funds are held in T-bills to generate yield.

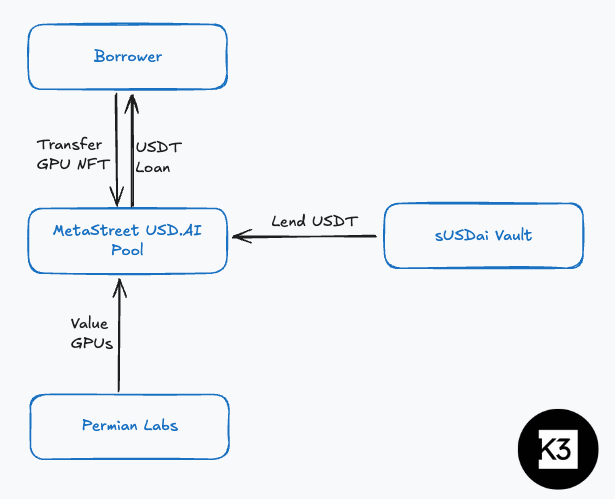

Step 2: On-Chain Loan

A borrower can take their GPU NFT and post it as on-chain collateral to borrow from the USD.AI lending pool, which is supplied by sUSDai collateral. The valuation of GPUs is handled by Permian Labs and assumes the retail value of GPUs with standard market depreciation. USD.AI uses MetaStreet to facilitate these NFT-collateralized loans.

Default Process

If a borrower fails to make their loan payment requirements every 30 days, then a default event is triggered. The GPU NFT is sold via an on-chain auction, and the winner of the auction can reclaim the underlying GPU with a 14-day notice.

FiLo Curator

First Loss (FiLo) Curators are governance-approved underwriters that typically originate loans, but also take on the first-loss position of a loan in exchange for a higher yield (effectively, acting as the junior tranche of the loan). This protects sUSDai holders in case of rapid devaluation or other shocks that impact loan health. In addition to FiLo Curators, USD.AI employs several other risk management techniques to shield sUSDai holders from potential losses:

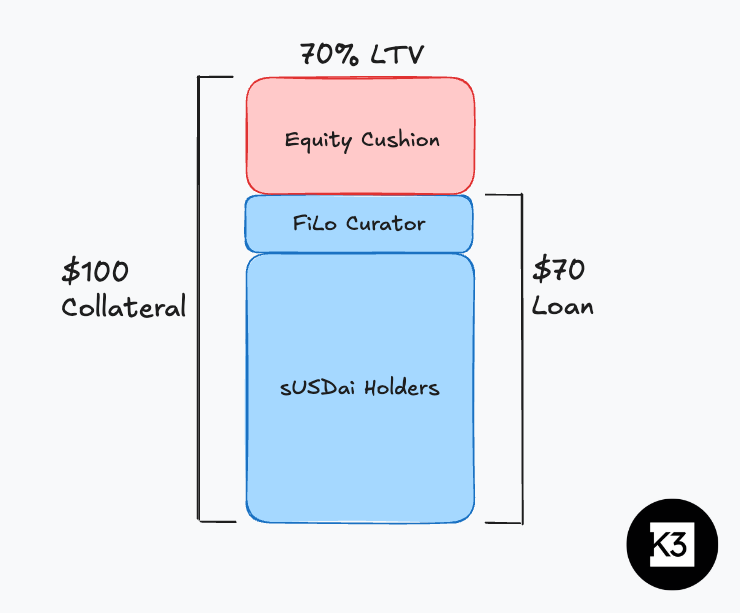

Loan Capital Stack

USD.AI loans are structured using a layered capital stack. sUSDai holders are shielded from collateral risks as any downturns are first absorbed by the borrower through the equity cushion and then the FiLo Curator.

Amortization

Amortization is the process of reducing the loan value by gradually repaying both interest and principal. USD.AI uses an aggressive amortization schedule, which makes principal payments upfront to reduce collateral exposure. Additionally, USD.AI underwriters apply a 3-year depreciation schedule for GPU assets, significantly shorter than the typical 5–7 year economic lifespan used in the industry. This conservative approach helps reduce the risk of loss from asset value decline over time.

QEV

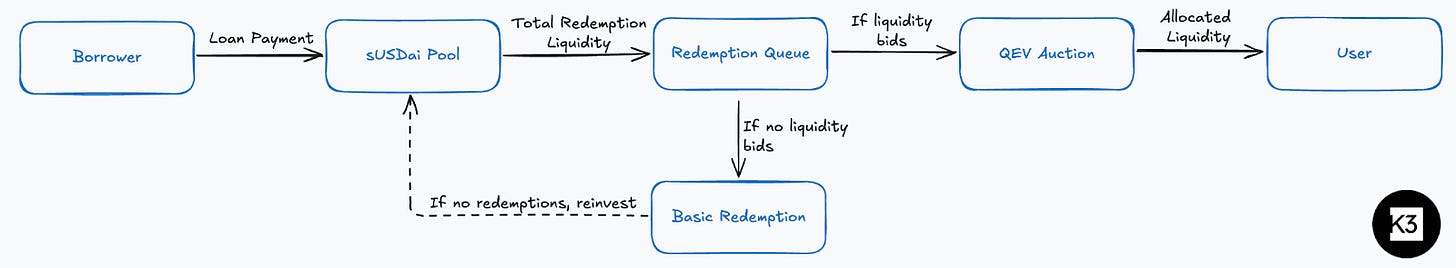

The flow of funds for redemption is as follows:

When a borrower makes a monthly loan payment, the funds are added to the sUSDai pool, increasing the available redemption liquidity for that period. This liquidity enters a redemption queue.

If no bids are submitted for this liquidity, it becomes redeemable by anyone through the basic redemption method. Any unused liquidity from this process is reinvested into the sUSDai pool, either by purchasing T-bills or issuing new loans.

If there are bids, a QEV auction is triggered, allowing users to compete for access to that redemption liquidity by placing bids.

QEV (Queue Extractable Value) offers a novel solution to redemption liquidity on low-liquidity assets by employing an auction system, making redemptions a priceable asset. Similar to how users can pay different levels of gas for priority transactions in EVM wallets, users can pay a basis points bid as “QEV gas” to gain priority for redemption liquidity. Another similarity between EVM transactions and QEV is the block-like structure. EVM transactions are sorted and executed in distinct batches called blocks; similarly, QEV redemption liquidity is distributed in a batch every 30 days.

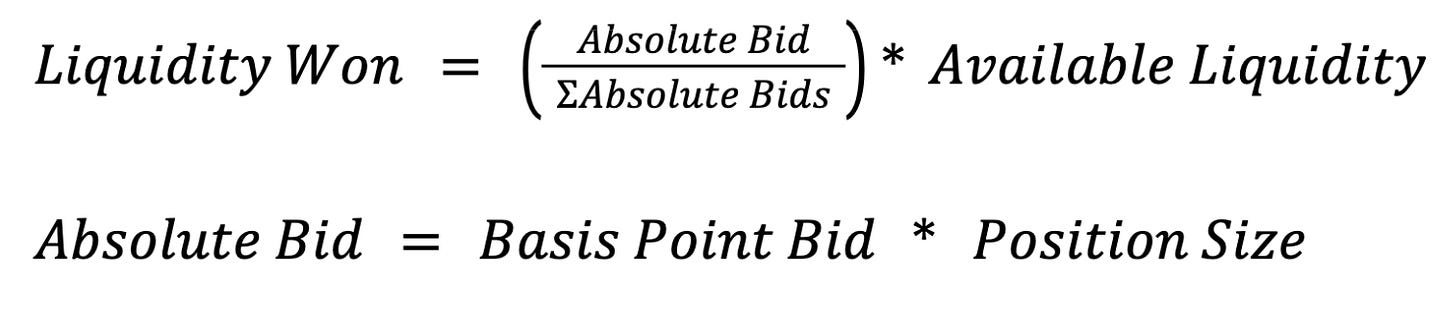

The amount of liquidity that each user gets per 30 days is reliant on the formula:

Essentially, each person’s basis point bid is scaled by their total position size in sUSDai to prevent whales from dominating the redemption queue and ensuring smaller investors can withdraw liquidity. These formulas are best seen in examples:

For each example, the available liquidity in this QEV batch is $25,000. All other bidders contribute an absolute bid size of $90

Example 1:

Josh has $10,000 deposited into sUSDai and wishes to withdraw liquidity. He decides to bid 10 basis points into the QEV auction. This means his absolute bid size is $10. Including all bidders, the total absolute bid size is $100. This means Josh can withdraw $2,500 with a 10 basis point bid and $10,000 deposited.

Example 2:

Josh has $20,000 deposited into sUSDai and wishes to withdraw liquidity. He decides to bid 20 basis points into the QEV auction. This means his absolute bid size is $40. Including all bidders, the total absolute bid size is $130. This means Josh can withdraw $7,692 with a 20 basis point bid and $20,000 deposited.

These examples show how the QEV auction scales redemption liquidity by both bids and total deposits. The fees from QEV auctions flow back into the USD.AI protocol, bolstering revenue. It should be noted that all bids are kept private via zero-knowledge proofs to avoid last block bidding on liquidity.

Financial Modeling

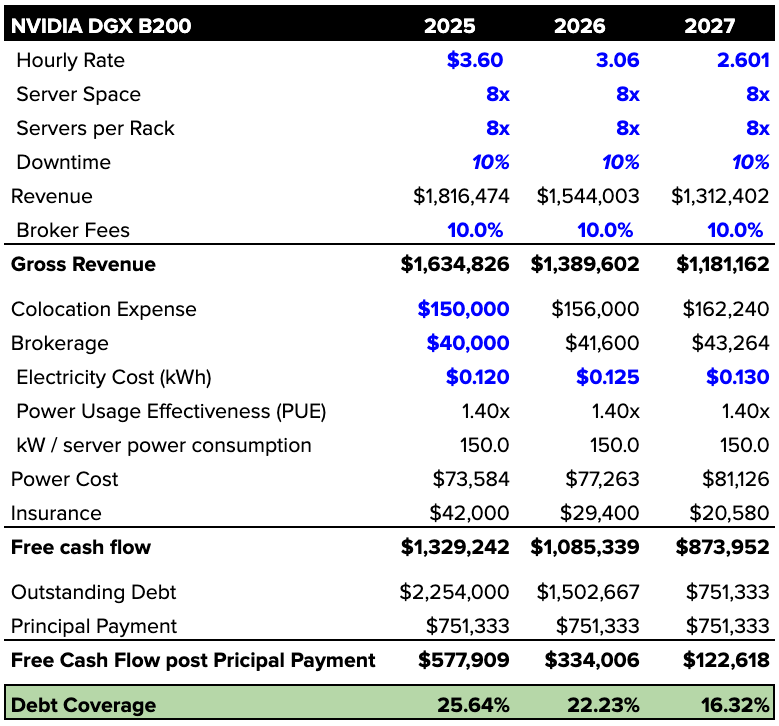

From the perspective of sUSDai holders, USD.AI functions as a vehicle to bring private corporate debt tied to data center infrastructure on-chain. To evaluate solvency and repayment capacity, we construct a simplified financial model of a GPU rental operation. This allows us to estimate the maximum sustainable yield that can be passed through to sUSDai holders without impairing debt repayment.

Hardware Composition: Financing is limited to NVIDIA DGX B200 servers. Each GPU costs $350,000, and an additional 15% of the purchase price is allocated for ancillary infrastructure such as racks, cabling, and supporting equipment. Each server contains 8 GPUs, and the modeled unit of analysis is a rack of 8 servers (64 GPUs total).

Capital Structure: Each rack purchase is financed with 70% debt (from sUSDai funds) and 30% equity. The debt is amortized monthly over a 3-year term, ensuring a predictable principal reduction schedule.

Revenue Assumptions:

Rental price per GPU: $3.60/hour in year one, with an expected 15% annual decline as new GPU supply enters the market.

Utilization rate: 90%, reflecting strong but not absolute demand.

Distribution/referral fee: 10% of gross revenue.

Gross revenue is adjusted downward for broker fees, colocation expenses, electricity, and insurance, leaving Free Cash Flow (FCF) available to service debt. Once monthly principal payments are subtracted, the remainder constitutes the residual cash distributable to both debt and equity holders.

From the debt perspective, the relevant metric is Debt Coverage Ratio (DCR), which represents the cushion between available cash and outstanding debt obligations. Conceptually, it captures the maximum feasible interest rate that USD.AI can distribute to sUSDai holders while still maintaining solvency.

Risk and Mitigations

A full list of USD.AI’s risks and mitigations is listed in their documents here. Here is a summary of some of the key risks and mitigations:

Underwriting Risk

Risk: The underwriting process can lead to a loss of funds if performed incorrectly.

Mitigation: The underwriting process for USD.AI is a comprehensive system that utilizes third-party appraisal, flexible amortization options, and an efficient default system.

Underlying Collateral Risk

Risk: Use of off-chain hardware introduces risk in case of hardware damage or rapid value loss.

Mitigation: An equity buffer, along with first-loss curators, helps protect against undercollateralization due to hardware value loss. To reduce potential losses from facility or hardware damage, all hardware must pass a proof-of-insurance check before being used as collateral.

Smart Contract Risk

Risk: Exposure to smart contracts from USDai, sUSDai, and MetaStreet (loan platform) introduces the risk of smart contract exploits

Mitigation: The USD.AI protocol has been audited twice with no high-risk findings found and has an ongoing $100k bug bounty program. MetaStreet has also been audited multiple times and has a $50k bug bounty program.

Conclusion

USD.AI addresses one of DeFi’s biggest limitations: the lack of yield-bearing credit primitives backed by real-world assets. By combining novel tokenized infrastructure collateral with a modular tech stack, USD.AI improves capital efficiency for AI infrastructure while creating a composable yield-bearing asset on-chain.

The FiLo Curator Model ensures underwriter alignment with USD.AI interests, CALIBER brings a new on-chain RWA standard, and QEV introduces redemptions-as-a-market. Together, these three pieces protect sUSDai stakers, generate additional fees for USD.AI, and ensure productive capital usage.

As the need for computing power grows with the boom of AI, companies will continue to look for effective capital solutions. Utilizing on-chain capital towards fueling the compute demand bridges DeFi liquidity with tangible economic output. In this way, USD.AI offers on-chain users a way to tap into a booming industry, backed by real value and carefully managed risk.