2025 First Half Recap

The first half of 2025 has been an incredible chapter for us. To set clear boundaries from the outset, K3 Capital’s role has remained focused on underwriting risk, supplying liquidity, and transforming complex market structures into investable, institutional-grade products.

Our mandate is straightforward: deliver stable, transparent returns while strengthening the resilience of the ecosystems in which we operate, pairing every deployment with open-source research and real-time risk dashboards. We curate purposely-built money markets and strategies across multiple networks and protocols.

Key takeaways

The GENIUS Act sets a clear U.S. framework for reserve‑backed stablecoins followed by World Liberty Financial’s USD1 momentum signalling that large traditional finance balances are preparing to move on‑chain.

K3 Capital now operates a cross‑chain suite of curated markets across leading DeFi venues (Euler, Morpho, Term Labs, Balancer, Pendle, Spectra, Liquity, Gearbox and more) with more than $250M in aggregated TVL, giving allocators diversified, risk‑segmented access to yield.

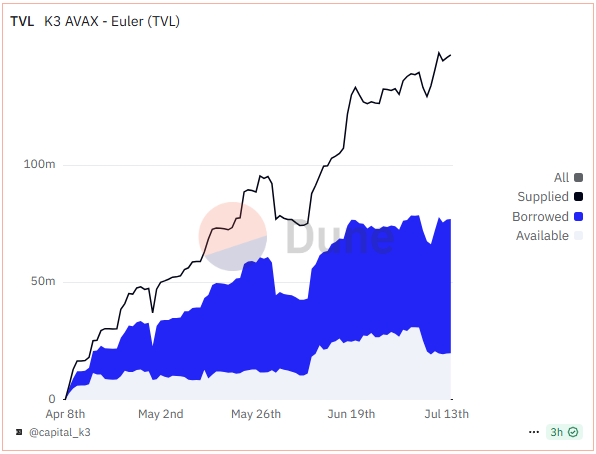

K3’s Avalanche Cluster on Euler has made us the platform’s largest independent curator; integrated Term Finance deposits and a Balancer Boosted pool enhance routing efficiency and deepen secondary liquidity.

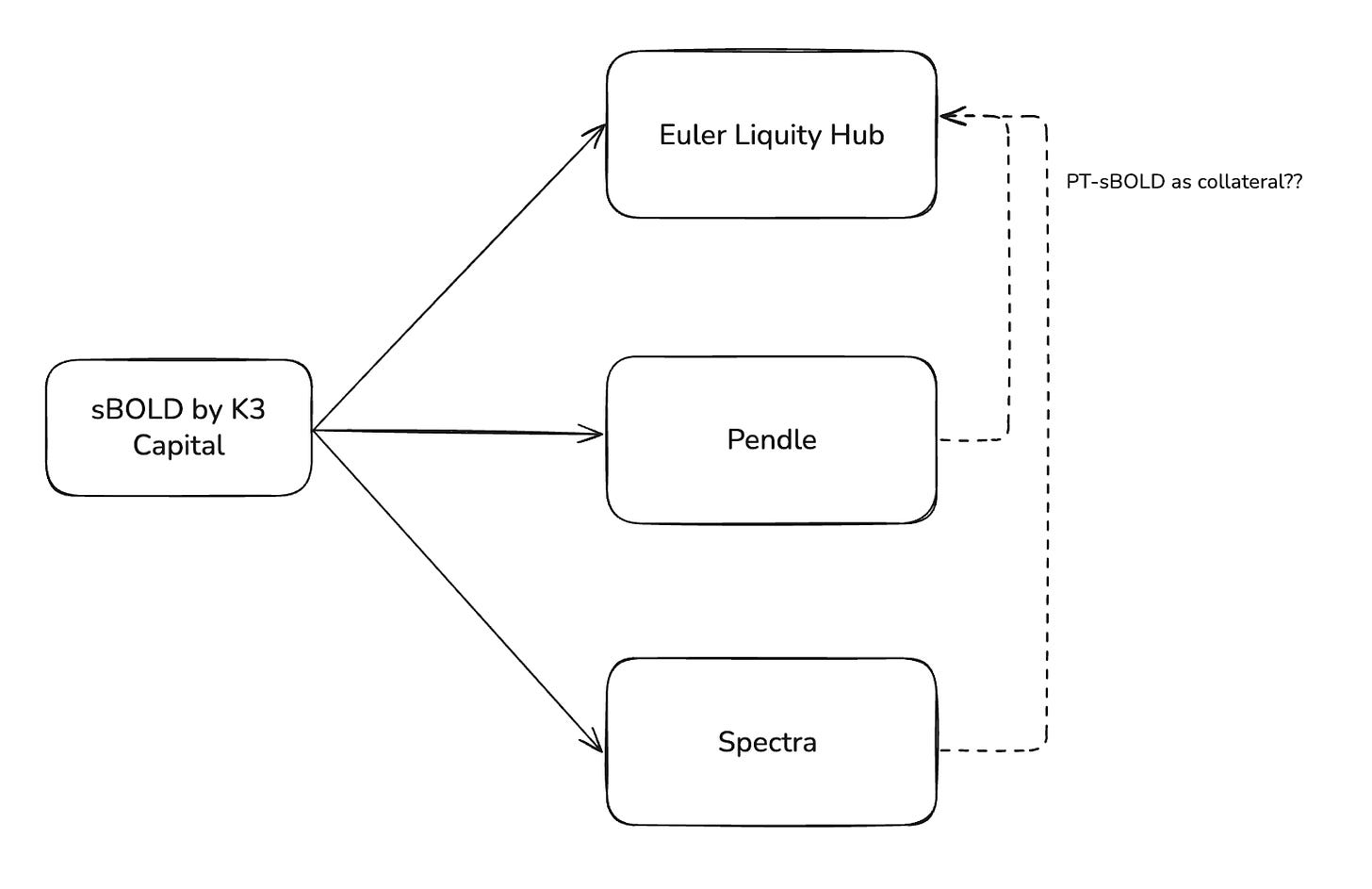

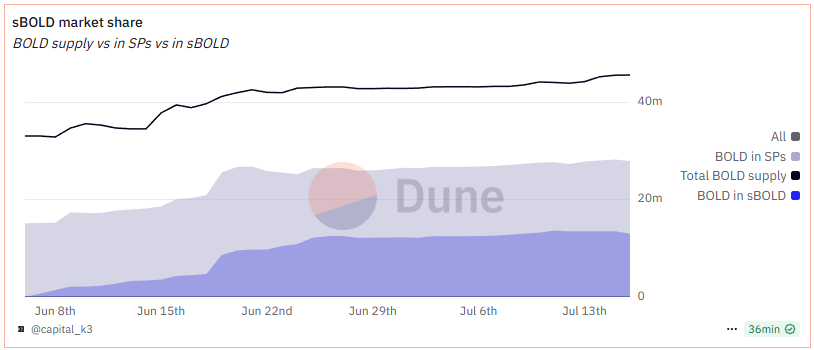

sBOLD by K3 Capital captured 46.2% of all BOLD deposited into the Stability Pools and is live as composable collateral across multiple downstream venues including Euler Liquity Hub, Pendle and Spectra.

The GENIUS Act Transforms Stablecoin Policy

The explosive growth of stablecoins and the accelerating tokenization of real‑world assets (RWA) have made dollar‑pegged digital cash the primary settlement rail in crypto. In every market cycle, stablecoins lead adoption because they are the only way for institutions to access the crypto ecosystem and tap into on‑chain liquidity also refer to decentralized finance. Given K3 Capital’s focus on providing institutional‑grade products in the DeFi market that allow idle liquidity to generate competitive yields, U.S. policy carries significant weight. Although the United States was not the first jurisdiction to legislate, about 99% of circulating stablecoin value is U.S. dollar‑denominated.

On June 9, 2025, the Office of Management and Budget issued a Statement of Administration Policy endorsing a federal framework for payment stablecoins. One month later, on July 18, 2025, the President of the United States, Donald J. Trump, signed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act into law. The legislation represents a turning point, introducing a robust and transparent regulatory framework for stablecoins that is expected to strengthen market confidence and set a new standard for digital asset oversight.

The Act mandates that stablecoins be:

Backed 1:1 by Highly Liquid Assets: Stablecoin liabilities must be matched by U.S. cash, Treasury bills maturing in ≤ 93 days, or qualifying government-money-market funds, preserving full and immediate redeemability at par.

Monthly disclosure and independent audit: Issuers must file CEO/CFO-signed reserve reports every month and undergo third-party attestations, with results made public to maintain continuous market transparency.

Equipped with Robust Consumer Protections: Mandatory AML/KYC controls and broader fraud-prevention measures align stablecoin operations with mainstream financial-compliance standards.

Prior to the GENIUS Act, stablecoin oversight was a disjointed tapestry of federal agency interpretations and state-specific rules, lacking the centralized, standardized framework it now introduces. This pre-existing landscape relied heavily on adapting legacy financial laws, leaving significant gaps in reserve standards, transparency, and consumer safeguards.

The new regulatory clarity positions stablecoin issuers to channel potentially trillions of dollars of liquidity on-chain with Treasury Secretary Scott Bessent projecting that a GENIUS-Act-compliant stablecoin sector could reach $3.7 trillion by 2030. Circle has already illustrated the model: USDC combines a regulated issuer with a broad distribution network via a revenue-sharing agreement with Coinbase. Likewise, World Liberty Financial’s USD1 signals to high-net-worth investors and traditional institutions that fully transparent, compliant stablecoins can serve as a trusted bridge into DeFi’s expanding markets.

In the near future, we at K3 Capital view the next major inflection point as the migration of traditional finance liquidity onto permissionless rails. As these balances flow on-chain, professionally curated DeFi markets offer an institutional-grade solution for idle capital - delivering competitive, risk-adjusted returns through fully collateralised money-market primitives and cash-and-carry strategies.

K3 Capital in Numbers (H1 2025)

During the first half of 2025 we actively curated more than $250 million in TVL across ten bespoke lending pools and yield hubs. Those markets admit collateral from more than 20 issuers, spanning reserve‑backed stablecoins and blue‑chip liquid‑staking tokens, and we also incubated sBOLD—a yield‑bearing ERC‑4626 wrapper for Liquity v2 deposits that has already become a core asset in our strategy stack.

Euler Finance

Among all the money markets we have curated, Euler Finance remains our top performer, with approximately $189 million in total TVL, spread across five markets on four networks - Ethereum, BNB Smart Chain, Avalanche, and BOB. In fact, this makes us the largest independent curator on the platform compared to anyone else.

Euler Finance is a permissionless, risk-isolated lending protocol that lets any ERC-20 asset be supplied or borrowed under dynamic, on-chain risk parameters. For a comprehensive breakdown, please refer to our summary → Euler Finance by K3 Capital

Since April, we have brought $148 million in TVL to this cluster via Avalanche and onboarded a total of 14 issuers, including: USDT (Tether); weETH (Ether.fi); savUSD (Avant Protocol); sdeUSD and deUSD (Elixir); WETH.e; USDC and EURC (Circle); BTC.b, UTY, and yUTY (XSY.fi); WAVAX; sAVAX (Benqi Finance); and stAVAX (Hypha, formerly GoGoPool).

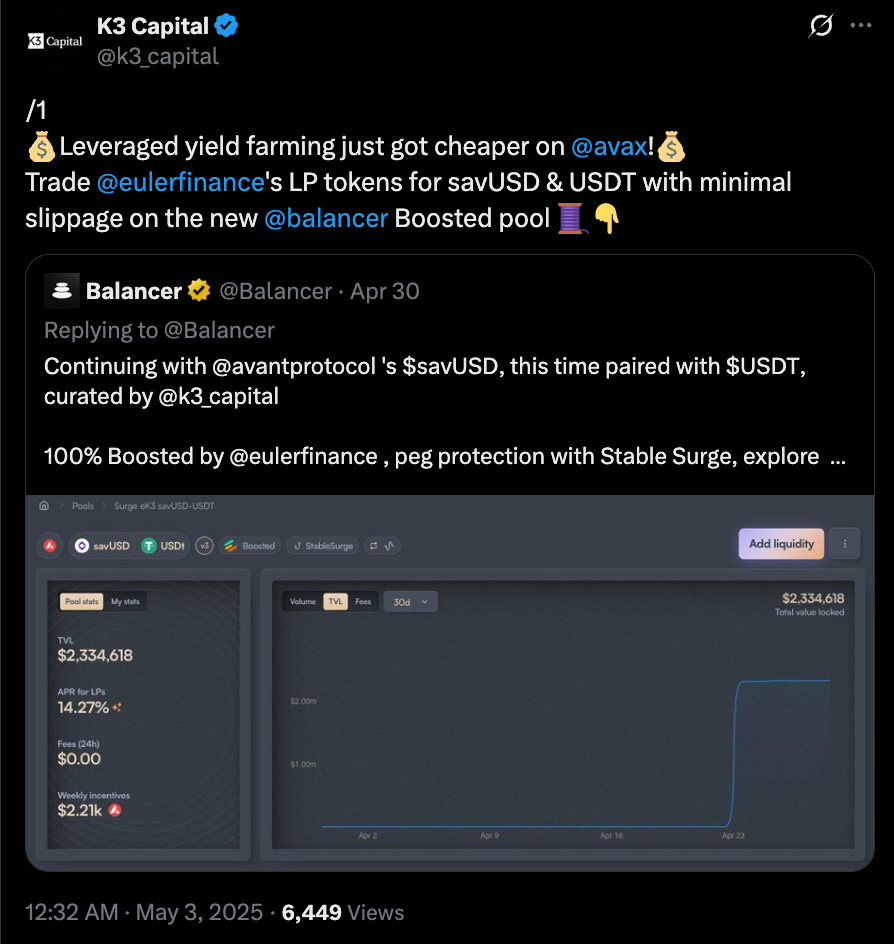

Balancer x Euler’s LP token (savUSD, USDT)

To deepen secondary liquidity and streamline exits, we launched a Balancer Boosted pool (savUSD‑USDT) in partnership with Avant Protocol and Euler. The pool offers LPs a triple‑stack of trading fees, Euler interest, and weekly AVAX incentives, while giving Euler users a one‑click path to lever up without material slippage.

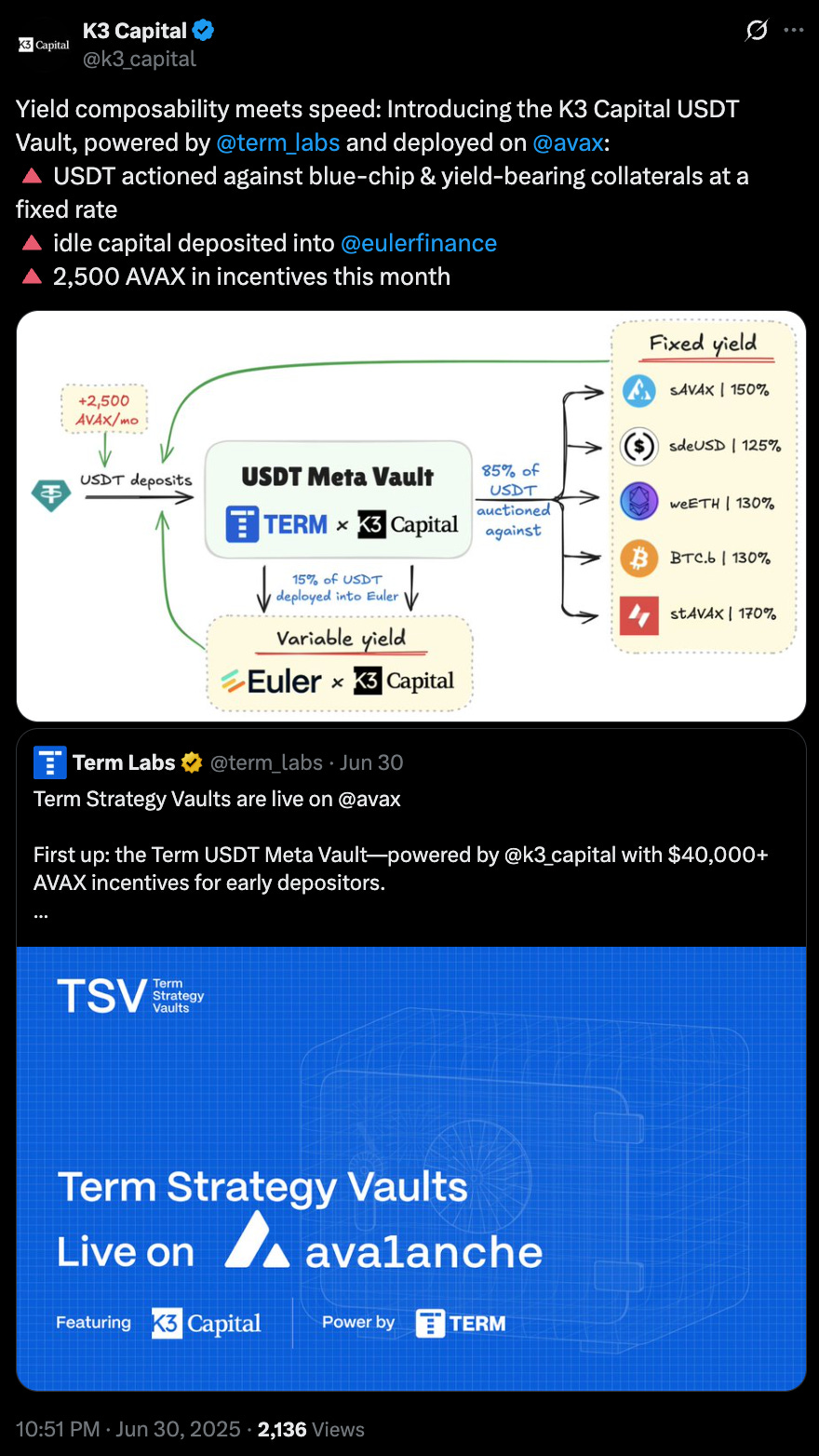

Term Finance

Additionally, we have partnered with Term Labs to launch the K3 Capital USDT Meta Vault on Avalanche. The vault routes 85 % of incoming USDT into Term’s fixed‑rate auctions - secured by blue‑chip and yield‑bearing collateral such as sAVAX, sdeUSD, weETH, BTC.b, and stAVAX, while automatically deploying the remaining 15 % into our Euler K3 cluster for variable yield. This dual‑leg structure eliminates idle capital, maximises blended returns, and comes with 2,500 AVAX in launch incentives for early depositors.

Morpho

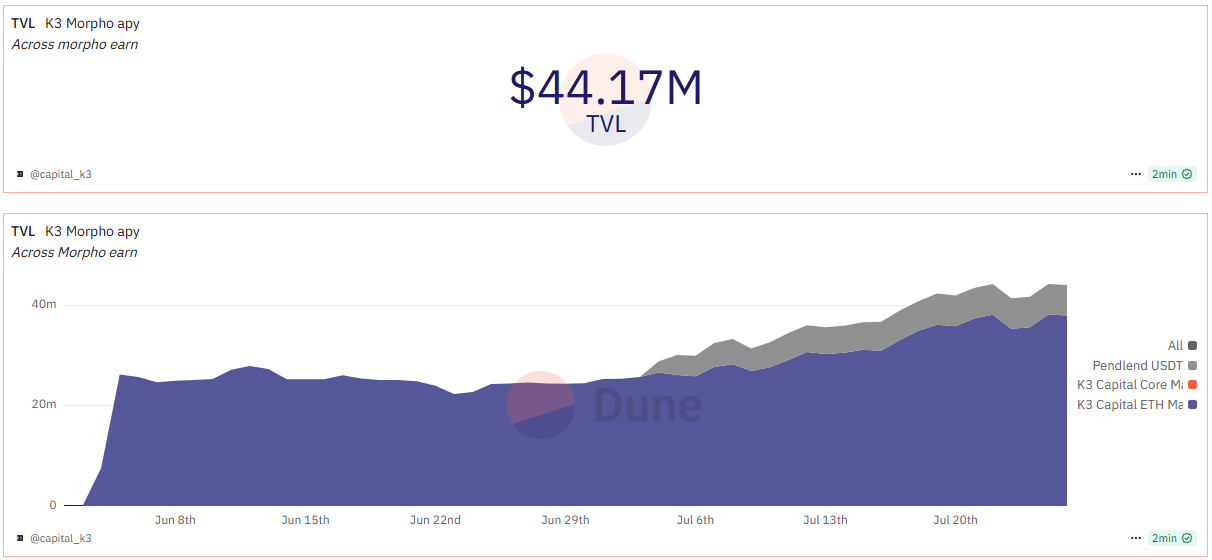

Morpho operates an isolated-lending architecture that lets curators configure vaults to match specific risk and liquidity profiles. In June, we expanded our presence on Morpho by launching two new strategies - K3 ETH Maxi and K3 Core Market on Unichain, followed later by the Pendlend USDT vault on Ethereum.. Together, the three vaults now manage about $44 million in deposits, providing institutional users with transparent, capital-efficient access to ETH leverage, stablecoin carry, and multi-asset core exposure under a single, risk-segmented framework.

K3 Capital ETH Maxi and Core Market

On Unichain, we launched two purpose‑built MetaMorpho vaults designed to give institutional users targeted exposure with clear risk bands:

K3 ETH Maxi – a delta‑neutral structure that lets depositors borrow WETH against liquid staking receipts wstETH, weETH, rsETH and capture subsidised yield. Ether.fi tops up returns with an additional 0.5 % ETHFI incentive.

K3 Core Market – a USDC lending pool collateralised by Unichain’s most liquid assets (ETH, wBTC, wstETH, weETH, UNI).

Both vaults are enrolled in the 12-week Unichain × Morpho rewards program, which allocates $500K in USDC to suppliers in the K3 ETH Maxi vault, along with MORPHO rewards for both lending and borrowing.

Pendlend

Pendlend is a USDT lending pool that accepts both Pendle LP Tokens (LPs) and Principal Tokens (PTs) as collateral. By wrapping the underlying yield assets, these tokens stack multiple income streams while still granting borrowers access to leverage their position.

The vault launched with high‑conviction pools such as:

LP‑sUSDE‑25SEP and LP‑sUSDE‑31JUL by @ethena_labs

LP‑eUSDE‑14AUG by @etherealdex

PT‑csUSDL‑Jul‑31 by @0xCoinshift

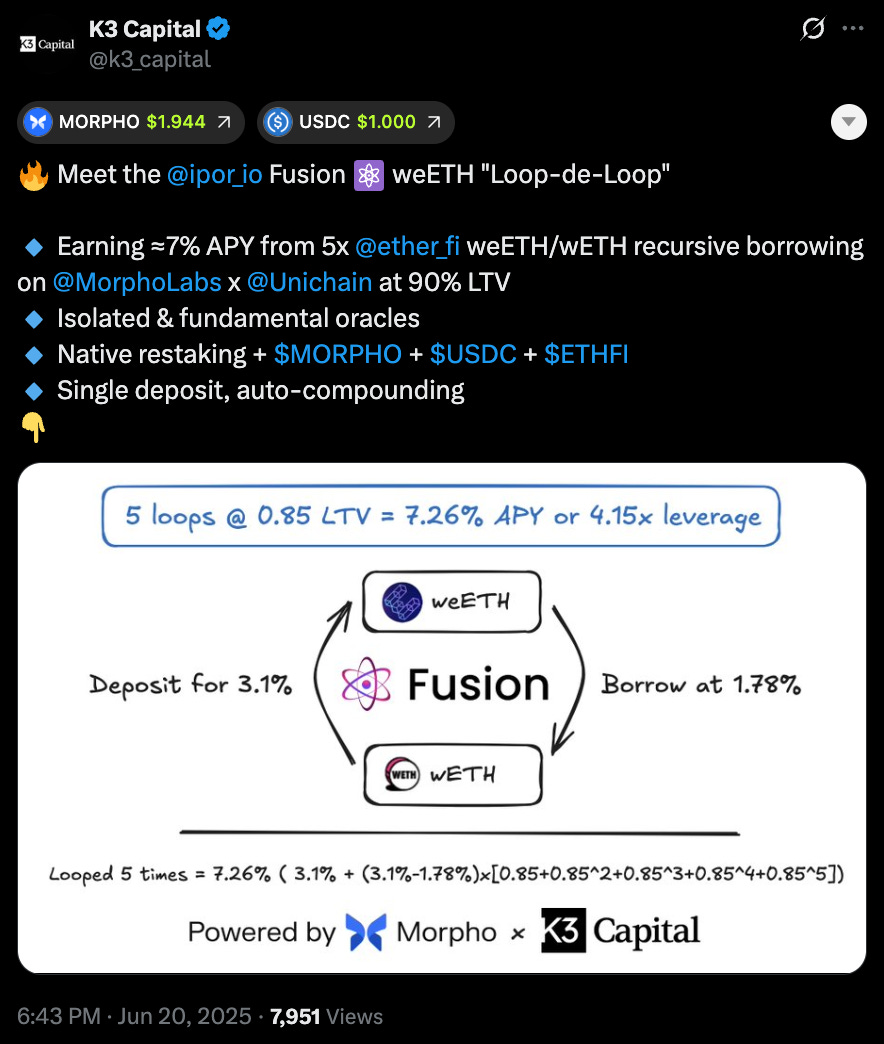

IPOR

On top of K3 ETH Maxi, we partnered with @ipor_io to make the same market accessible through Fusion, IPOR’s single‑deposit yield router. Fusion automates a five‑loop recursion on the Morpho weETH/wETH market at 85% LTV:

Deposit weETH as collateral → borrow wETH at 85% LTV.

Swap borrowed wETH back to weETH on‑chain.

Re‑deposit and repeat for five times, compounding both native staking yield and Ether.fi incentives.

Fusion provides a sophisticated looping strategy into a single click; for K3 Capital, it broadens the distribution of ETH Maxi without fragmenting liquidity or adding operational overhead.

sBOLD by K3 Capital

On June 9, 2025, we launched our very first standalone product – sBOLD. sBOLD by K3 Capital is a yield-bearing tokenized representation of a deposit into Liquity’s v2 Stability Pools based on a weights set on deployment. The protocol will initially accept BOLD deposits and route them into the wstETH, wETH and rETH stability pools in fixed proportions (60%, 30% and 10%, respectively). In return, the depositor receives an ERC4626 token that could be integrated with third-party protocols like money markets, decentralized exchanges and yield trading platforms for improved capital efficiency.

sBOLD possesses a rebalancing feature by which the weights and Stability Pools can be changed, and funds are reallocated to the respective Stability Pools at the new ratios; K3 Capital will act as the vault administrator and sets and executes the allocation ratios.

More on sBOLD: Gitbook | sBOLD product rationale

Within its first month post‑launch, sBOLD moved from a standalone savings receipt to composable collateral across multiple DeFi venues.

Depositors can supply sBOLD to the Euler Liquity Hub and borrow against it for leverage or working‑capital strategies; deploy sBOLD on Pendle or Spectra to tokenize yield into Principal Tokens (PT) to lock fixed‑rate, take Yield Tokens (YT) for levered yield / incentive capture and gain leveraged exposure to 20+ Liquity’s forks airdrop, or provide LP liquidity for balanced two‑sided exposure plus protocol subsidies.

As of 17 July 2025, total BOLD supply at around 46M. Roughly 28M BOLD is deposited across Liquity v2 Stability Pools, and sBOLD now represents ~46.5% of that deposited BOLD - a meaningful share less than one month after launch. The rapid uptake underscores demand for an auto‑rebalancing, ERC‑4626 wrapper that can be mobilized across downstream venues.

Notable Highlights

K3 Stablecoin Vault Launch on Gearbox

Pendle Institutional highlight

Accountable x K3 Capital x Aegis

Closing Thought

At K3 Capital, we see the back half of 2025 as the moment when regulators, TradFi balance sheets, and permissionless markets finally converge. With the GENIUS Act in place, dollar‑backed stablecoins now have a clear rulebook. Having $250 million already deployed under our curation, we are positioned to guide the next wave of institutional flow toward transparent, risk‑segmented on‑chain venues.

Our task for the remainder of the year is straightforward: maintain uncompromising, institutional-grade standards for collateral and counterparties while continuing to make it effortless for capital to access competitive on‑chain yield.

For further inquiries and the latest updates, please visit our channels:

X | Website | Substack | @k3alpha | Dune dashboard